Current hypothesis: [fingers crossed emoji]

There’s no single technology more critical to the energy transition than electric vehicles. If the energy transition succeeds, they’ll be ubiquitous. If it fails, there’s a good chance that weak links in the supply chain will be responsible.

That’s why I’m especially sorry to say this is the best answer I can muster to the question of whether that supply chain will hold:

EVs are THE pivotal energy transition technology because there is no good substitute.

Clean hydrogen was once seen as a contender against batteries in the race to decarbonize transportation. It’s still probably the best fallback option if electrification falls short. But lithium-ion batteries have now decisively beaten hydrogen as the most practical and cost-effective solution for powering light & medium duty vehicles. Hydrogen produced via electrolysis & run through a fuel cell has a power-to-wheels efficiency of about 25%, while direct electrification can achieve about 70%.1 Hence, we’d need to build nearly three times as much zero-carbon power generation to fuel our vehicles with tanks of hydrogen as we would with lithium batteries. Clean hydrogen is also miles behind vehicle electrification in terms of supply chain investment and infrastructure readiness. Major global vehicle OEMs are now, in the parlance of poker, “pot-committed” to EVs. Hence, if the EV supply chain fails, our next best option is not just fundamentally inferior; it’s also more than a decade behind.

The EV supply chain is defined by the lithium-ion battery supply chain.

Lithium is the lightest metal (in fact, it’s the third lightest element). So far, nobody has come close to developing a battery with the same combination of energy density, cycle life, and efficiency. The device you’re reading this post on is probably powered by a lithium battery, and my guess is there are a couple more within three feet of your body. If you’re in the US, there’s now about a 1% chance that lithium batteries are powering your car.

And it’s not just vehicles. I guarantee, the more you look for opportunities to replace fuel tanks with batteries, the more you’ll find. At EIP, we’re especially enamored by electrified replacements for small diesel engines, as diesel is remarkably low-hanging fruit. Most diesel engines are terrible in just about every way: they’re loud; they’re polluting (think EPA criteria pollutants, not just carbon); and because they’re so inefficient, they’re quite expensive to operate!

So, at EIP, we’ve invested in both Moxion Power and Instagrid, which deliver a range of portable, battery-based gensets to power all manner of temporary job sites, from construction projects to food trucks.

And, we invested in Scythe Robotics, which is making the world’s first electric, autonomous commercial lawnmowers. According to the EPA, lawnmowers today are responsible for 5% of the worst criteria pollutants (!) and all of that pollution is emitted right beside our homes, schools, baseball fields, etc.

Of course, lithium batteries have also made the leap from vehicles to the electrical grid. It’s not strictly necessary to employ the lightest metal for big, stationary battery systems, and over time I expect a variety of alternatives to take over from lithium in grid storage. But for now, the scale of the lithium-ion battery industry has made it the most cost-effective choice for storing energy for relatively short periods on the grid. (“Short periods” = two to six hours.) We’re currently living through the inflection point for this type of grid-scale storage system.

Lithium-ion batteries have come a long way in a very short period of time. The core technology has steadily improved since it was first commercialized by Sony in the 1990s. Since 2010, the industry has managed to boost key performance metrics like energy density and cycle life by an impressive 25-50%. Even more impressively, this progress was achieved amidst a roughly 1000X expansion of the global supply chain.

It was just a decade ago, in 2013, when Tesla announced plans to build the world’s first “gigafactory” in Nevada – a plant capable of producing fifty gigawatt-hours of batteries each year - which was about a hundred times bigger than any operating facility at the time. (One gigawatt-hour is enough battery capacity for about 14,000 EVs.) Today the world has more than ten times that production capacity, and dozens more gigafactories are in the works.

As the industry expanded to gigawatt-scale production, the cost of lithium-ion batteries plummeted. In 2010, today’s typical 70 kilowatt-hour EV battery would have cost about $70,000.2 That’s just the battery, not the whole car! By 2020, the same battery cost about $10,000, weighed less, took up less space, and lasted longer.

Never, ever bet aganst economies of scale!

Even with all that progress in the rear-view mirror, there’s still plenty of theoretical opportunity to keep making lithium batteries better. While we at EIP have yet to place a bet on any next-generation successor to today’s lithium-ion variants, it’s quite possible that new materials will continue to push the envelope on energy density, charging speed, safety, and perhaps even cost. My personal best guess, from reading market tea leaves & speaking with lots of early-stage companies, is that density & fast-charging will improve by another 25-50% by 2030-ish. [Personally I’m bullish on silicon anodes, skeptical of solid-state electrolytes, and hopeful for sulfur cathodes. But you should look elsewhere for detailed battery chemistry advice…]

So, welcome to The World That Lithium Batteries Built™….Unless, that is, the world can’t produce enough of them, or geopolitical conflict screws up this whole endeavor.

About that astoundingly fast-growing supply chain…

Lithium-ion batteries depend on a bunch of relatively scarce minerals that are mined & refined across a global supply chain. Many of these inputs travel around the world at least twice before reaching their final destination in a smatphone or a vehicle.

Lithium itself is the most obvious, and ultimately the least substitutable element in the mix, but battery electrode materials are also troublesome. In the case of negatively charged anodes, we currently rely on graphite, a particular form of solid carbon. For positively charged cathodes, most vehicle batteries today demand some combination of nickel, manganese, cobalt, and aluminum (NMC/A).

Fortunately, these cathode materials are much more replaceable than lithium. Cathodes made from lithium-iron-phosphate (LFP) are far cheaper & easier to source than NMC/A blends, and they’ve already become the go-to standard for stationary storage. Despite the fact that LFP is about 25-30% less energy-dense than NMC/A at the cell level, it’s even begun to make surprising headway in high performance vehicles. In part, that’s because LFP’s superior safety profile means cells can be produced in larger formats & packed more closely together. I’m becoming increasingly convinced that LFP can displace NMC/A in many - perhaps even most - applications.

This would be a very, very good thing for the EV industry, mostly because of the ‘C’ in NMC/A. Cobalt is an existential risk from nearly every standpoint. Known reserves of cobalt have the highest geographic concentration of any energy transition mineral. Even more disturbingly, that concentration happens to be in the Democratic Republic of Congo, which is notorious for human rights abuses & other governance concerns. And on top of that, known reserves of cobalt are probably not even sufficient for mass market global EV adoption! Thank goodness, cobalt is probably the least deserving of its position on lists of critical battery minerals.3

Perhaps even more exciting than progress on LFP, there is actually one nascent, potential substitute for lithium itself on the cusp of commercialization, which is sodium-ion. The Chinese battery giant CATL has announced an initial vehicle OEM customer for its first-generation sodium-ion cells. CATL also claims that its sodium-ion manufacturing process can leverage established lithium-ion manufacturing equipment (with some retooling), which is a huge deal because we’re currently in the midst of a lithium-ion gigafactory boom. For now, the market consensus seems to be that sodium-ion’s energy density will remain too low to compete with lithium in most EV applications. However, this is a space to watch, as it might just bubble up into one of the most game-changing surprises in the next decade.

So, there are some positive signs on the horizon for EV battery minerals. However, the material impact of electrification won’t stop with batteries. EV motors are just as essential; and lightweight, high-performance motors are utterly reliant on two additional inputs: copper, and a handful of “rare earth” elements.

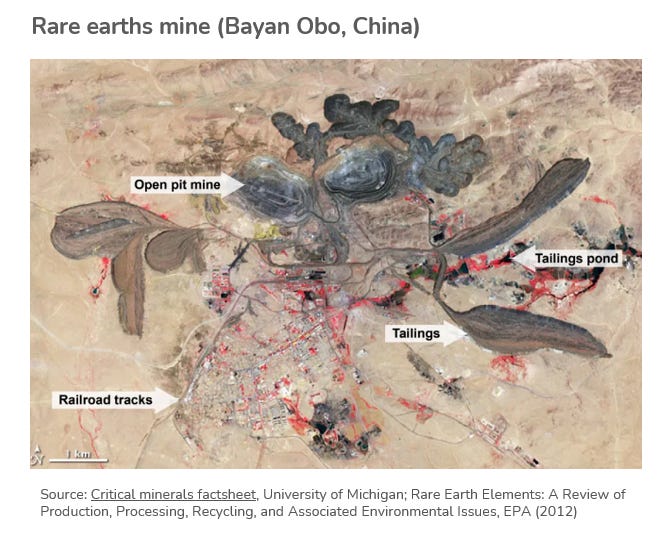

“Rare earth” is a bit of a misnomer, as these metals are not actually all that scarce on our planet, but they are quite hard to find in high concentration. Copper, meanwhile, is already the third most consumed metal in the world, so even relatively small percentage increases in demand will need to be met with a daunting amount of new mineral supply. To top it off, demand for both copper & rare earths will also be intensified by growth in wind turbine manufacturing, the expansion of the electricity grid, and all kinds of unrelated infrastructure.

Stepping back to look at the big picture

Critical energy transition minerals each have their own stories, but they also have a lot in common. Here’s some common themes:

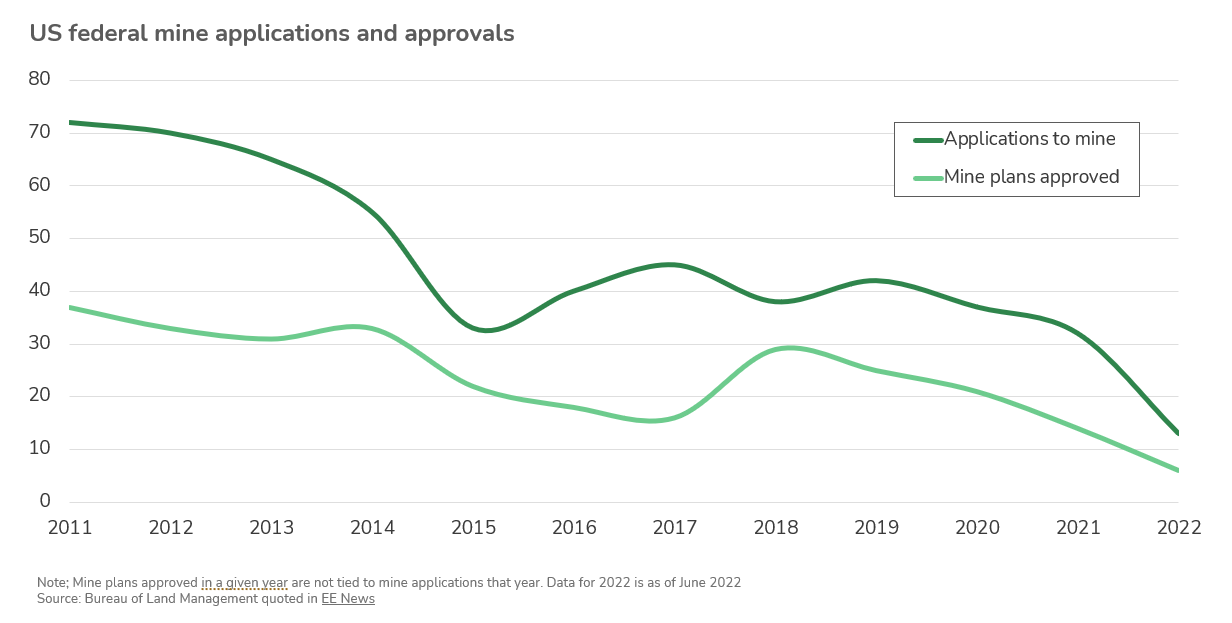

The principal risk to the growth of raw material supply is generally found above-ground, not below. US Geological Survey estimates of reserves for all of these minerals suggest that we ought to be able to mine enough of them to electrify anything we might want to electrify over the long term. (The one exception is probably cobalt, as I’ve discussed.) In short, the lithium battery revolution won't end for want of lithium, or nickel, or copper, etc....at least, not for want of acceptably high concentration deposits of these minerals in the earth’s crust.

Nevertheless, we’re going to have a hell of a time mining & processing these raw materials into EV-ready inputs as fast as demand is going to increase. New mining projects are super risky endeavors – beset by sustainability challenges and riddled with doubts about the volume & grade of ore beneath the surface. Mines often take a decade or more from the time of initial discovery to the time they begin producing minerals. In the extreme cases of nickel & copper, lead times for new mines over the past decade have averaged more than 15 years. The world’s last two major copper mines took about 30 years each!

Recycling will probably be necessary, but it’s far from sufficient. The same can be said for re-use, which mostly refers to “second-life” battery solutions, which employ spent vehicle batteries that still have enough life in them for less demanding applications. These two R’s could eventually be substantial steady-state contributors to battery supply, but in the next decade or two their role will be pretty modest. By 2030, battery recycling & re-use combined could probably supply about 10-15% of the critical mineral inputs to fresh battery products.4

Production and reserves of these minerals tend to be fairly concentrated, geographically speaking. The energy transition is also going to be an enormous geopolitical transition.5

Specifically, on that last point, the vast majority of these minerals are either mined, refined, processed, or all of the above, in China. For example, it’s well known that China is the dominant manufacturer of lithium-ion battery cells, although North America and Europe are making decent progress towards building their own domestic capacity. What’s less visible is that China still produces more than 90% of all of the intermediate materials - namely electrode powders and electrolyte precursors - without which all of the West’s shiny new cell manufacturing plants would sit idle. Wherever in the world lithium et al. originate, nearly all roads to a finished battery pack pass through China. (Thanks to my EIP colleague Bryant Ebright for the chart below, as well as lots of additional guidance on this post.)

Points 2 & 5 above are related, of course. There’s a reason China is the undisputed hub of the global battery industry. It’s the same reason China remains the “workshop of the world” in so many other industries…

China can build things.

Big things!

Fast.

Even when they come with environmental risks.

Currently, the United States…just can’t.

This inability to build big things in America is emerging as one of the biggest macro themes in energy & climate tech. See, for example, my prior posts on the prospects for electric transmission, and nuclear energy in America. Actually, this phenomenon is at the foundation of all kinds of problems in the US, among other Western democracies (though none other quite so acutely, it seems).

Of course, this problem goes way beyond energy. Several other great writers, like Noahpinion and Ezra Klein, have already written eloquently about it, and have made the case for sweeping reforms to government procurement & permitting processes in order to bolster mission-critical projects. (“Mission-critical” = “Essential to economic & national security”)

Often the biggest above-ground obstacles to big new mining and refining projects are environmental. Permitting hurdles have made these sorts of projects uneconomic to develop in many countries (well beyond the US) without China’s distinctive blend of capital availability, tolerance of environmental hazards, and of course authoritarian governance to quash dissent.

And, by the way, I get it! Who wants to live near a rare earth element mine?

Who wants to live near these lithium brine evaporation ponds?

Lithium in particular is worth reflecting on, as it’s fast-becoming a poster child for “above-ground risk” to the mineral supply chain. The majority of the world’s known lithium reserves are located in just three countries in South America: Chile, Bolivia, and Argentina – collectively known as the “Lithium Triangle”. Lithium in The Triangle is currently extracted from underground brines which contain less than 0.1% lithium.

To get to that lithium, the current production method spills those brines into massive evaporation ponds exposed to the desert sun (see above). Beyond this use of solar energy, the rest of the conventional production method is an extremely inefficient process, typically recovering less than half of the total lithium available. Plus, the unmistakable land & water impact of this approach has made it a flash point for environmental conflict with local communities. Combined with other governance issues in the region, these clashes have made siting & permitting new mines extremely challenging. The result is that production in the Lithium Triangle has stalled out. In fact, nearly all new supply in recent years has come from Australian rock-bound lithium resources, which are a much less robust long-term supply option.

The great theoretical ‘unlock’ for lithium brine is some form of “direct lithium extraction”, or DLE, which doesn’t rely on giant evaporation ponds and can return the vast majority of the brine that’s not lithium back into underground aquifers. Both startups and large incumbent players are pursuing a variety of pathways to DLE, and I’m hopeful that there will be a number of successful solutions. Like most of the EV supply chain problems we face, I’m convinced this is a solvable problem…but it’s still far from solved.

So, will the EV supply chain hold?

Will US-China relations hold???

More pragmatically: While we wait, fingers crossed, for the great powers of the world to settle their differences, what can be done to make the EV suppy chain more robust?

At my firm EIP, we’re always on the lookout for solutions that make it easier to extract, refine, process, and ultimately recycle EV materials - and we tend to get especially excited about solutions that make it easier to do these things outside of China.

For example, several years ago we invested in the lithium battery recycling company Li-Cycle, which has since gone public as one of the largest players of its kind in North America - with industry-leading mineral recovery efficiency. Relatedly, we just recently announced an investment in Cyclic Materials, which is following a similar playbook to scale up a specialized recycling business for high performance motors & other e-waste. Cyclic has a particular focus on rare earth elements, the highest value components in those motors, for which the current recycling rate is less than 1%.

We’re also investors in 6K, which has developed a proprietary microwave plasma based process for manufacturing a variety of engineered materials, including battery electrodes. This process is dramatically less energy, water, and waste intensive than the standard co-precipitation method for producing battery cathode powders. That means 6K factories can be permitted & operated within the bounds of stringent Western environmental permitting regimes. Hence, we believe this technology could underpin the rapid development of more robust domestic battery supply chains.

Lastly, we’ve become pretty obssessed with copper…Keep an eye out for an announcement on this front! [Update! In June 2023, EIP announced an investment in Ceibo, a novel approach to copper extraction which can dramatically increase production at existing mines, with less environmental impact.]

…and of course, we’re continuing to investigate additional opportunities across this landscape.

Enjoy this post? Please check out the rest of the Ten Biggest Questions in Energy & Climate Tech

“Power to wheels efficiency” means the amount of energy produced by a primary energy source - e.g. wind, solar, or nuclear power - which ultimately translates to motive power in a vehicle. Electric vehicles benefit from the high efficiency of electric motors (upwards of 90%) compared with combustion engines (30-40%) or hydrogen fuel cells (40-60%).

Assuming a 70 kWh EV battery, which was roughly the average size in 2020.

At about 150 tons of cobalt per GWh of battery capacity, our current known reserves of cobalt (8.3m tons) could only supply about 800m electric vehicle batteries, which is far short of full global electrification. Even halving the amout of cobalt per battery would not be sufficient.

In addition to exploring LFP batteries in vehicles, the EV industry’s response to its existential cobalt problems so far has been to attempt to use less cobalt and more nickel. This strategy has worked pretty well, and there’s a chance that next-generation technology could transition cathodes towards even more nickel & manganese dominant blends. The holy grail for cathode materials is sulfur, which is cheap, abundant, and lightweight. So far, that’s turned out to be an extraordinarily elusive grail, but nonetheless one worth pursuing.

One area of concern to keep an eye on for LFP is phosphorus supply. It’s not a big problem today, and at a macro level batteries are unlikely to consume a major share of the phosphorus market. However, phosphorus is beginning to get more attention as a critical point of vulnerability in our global fertilizer, and therefore food supply chains.

From IEA’s excellent report on “The Role of Critical Minerals in Clean Energy Transitions”, May 2021

Note to self: Consider a move to Chile, which is rich in both lithium & copper!

what do you think about india in the context of whole li-ion/future of batteries business?