Adolescence for renewables, retirement for oil

On critical energy resources entering awkward life stages

Adolescence and retirement tend to be two of the most awkward stages of human life. So it is for humans, so it will be for energy resources.

Wind & solar power have reached a level of maturity that’s fairly comparable to human children in their teens. Coincidentally, it’s been about 13-18 years since the ‘birth’ of the modern solar & wind industries, respectively. Most of us look back on our teenage years with a distinctive blend of exhilaration and anxiety. So, for renewables, consider this a coming of age story.

Meanwhile, the oil industry is older than any living human… and it’s time to begin taking steps towards retirement.

Retirement can be a challenging time for many older adults. In my own family, there are stories of my grandfather heading in to the office at a Chicago bank through his 70s, and even into his early 80s. He wanted to feel like he was contributing to society, and he loved to mentor younger workers. Also, frankly, he probably didn’t know who he would be, if not a banker.

These days, older adults seem to be delaying retirement long past the point at which heading in to the office every day is a charming quirk (ahem: Dianne, Mitch, Joe, Donald, etc). Why doesn’t anyone want to play bridge and go on riverboat cruises anymore?

Unfortunately, the oil industry is not welcoming this next phase of life, either; but the rise of electric vehicles will soon force the issue. The massive global petrochemical industry will need to accept its declining role, and take proactive steps to adapt in order to ensure a smooth transition into retirement. Just like Grandpas the world over, crude oil could still be highly valued… just differently.

The adolescence of renewables

Like most teenagers, renewables have just experienced a major growth spurt. In the US, the most recent surge was driven by clean power buyers attempting to secure as much supply as possible before the anticipated expiration of federal tax credits (that is, before those credits were extended for 10+ years by the Inflation Reduction Act). So, wind & solar have been sowing their wild oats, adding about as much new clean generation to the US grid in the past five years as they did in the prior ten.

In other words: renewables aren’t kids anymore. They now amount to nearly 15% of US power generation, and their behavior has real consequences for the US electricity system. Just look at the Southwest Power Pool, which spans the “wind belt” covering most of the Great Plains. Wind power now contributes about 40% of total annual electricity supply in the region, which entails frequent periods of excess supply. The result is an increasing incidence of “negative” electricity prices, which tend to occur when power plants that are unable to adjust their output rapidly (e.g. coal & nuclear plants) are effectively compelled to pay wind farm operators to curtail their production.1

Fortunately, like many teenagers, renewables have a new ‘best friend’ to support them through these kinds of ups & downs: energy storage. I’ve written previously about some of the most promising approaches to storing renewable energy (in “Four ways to store sunlight”). The short story is: I’ve grown quite confident in the potential for emerging storage technology to manage the variability of wind & solar without blowing up the cost of energy. In the meantime, renewables can continue to rely on their responsible older cousin, the natural gas turbine, as a backstop.

Even still, as renewables enter their teenage years, they’re beginning to experience a number of additional growing pains which could end up becoming even more intractable than intermittency. Individually, none of these growing pains is a showstopper; but in aggregate, they’re undoubtedly going to be a drag on the pace of deployment in the coming decade.

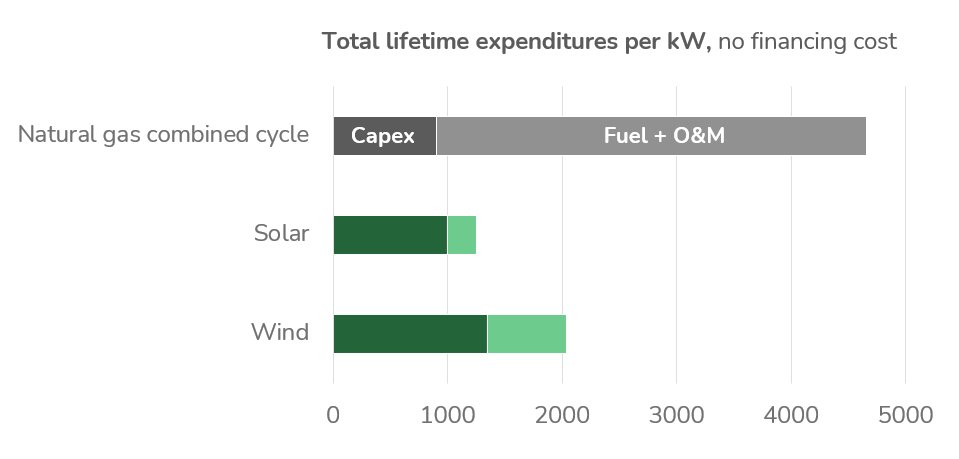

Growing pain #1: Cost of capital

One of the the most distinguishing features of renewable power is its capital-intensity. Because wind & solar “fuel” is free, the majority of the total lifetime expenditures of these plants need to be financed before they begin generating power. By contrast, about 80% of the total lifetime expenditures of a natural gas combined cycle power plant are spent over time on fuel, operations, and maintenance. This dynamic makes renewables much more sensitive than fossil generation to increases in the cost of capital. Of course, this is especially true when comparing a new wind or solar plant against an existing coal or natural gas plant, whose capex is already sunk.

We’ve been living through a historically anomalous period for the cost of capital. Since the beginning of the Great Recession, the US federal reserve has held the risk-free rate close to zero. Most renewables developers have never known a world without this “zero interest rate policy”, often referred to as “ZIRP”. They’re maturing into a very different environment.

Growing pain #2: Profitability

In short: The wind turbine supply chain needs to make more money. The solar panel supply chain (outside of China) needs to make more money. And the majority of solar farm owners probably need to make more money, too.

Wind OEM woes

The Western wind turbine business is dominated by three large “original equipment manufacturers”, or OEMs, who compete ferociously with each other for market share.2 All three have consistently adopted aggressive pricing strategies, while simultaneously spending heavily in order to sustain multiple product lines while pushing the boundaries on successive generations of turbine.

Check out this photo of a mold for a wind turbine blade. This is what it takes to manufacture half of a single blade, and each turbine needs three blades. In the past ten years, each of the big three wind turbine OEMs have gone through at least two big leaps in turbine size requiring an increase in blade size on the order of 50 feet!

The next time you hear the phrase “capital-intensity”, which comes up in most conversations about climate tech, I trust you’ll remember this image.

This combination of continuous investment & intense competition among turbine OEMs has been a boon for wind turbine buyers, not to mention energy consumers in windy regions. But for turbine manufacturers, this industry structure has led to persistently thin profit margins, even relative to other heavy industries. In the past three years, these margins proved insufficient to absorb the collective impact of inflation, labor shortages, supply chain hiccups, and unforeseen maintenance costs.

Here’s the CEO of Vestas, Henrik Anderson, in a note to shareholders:

“Vestas and the wind industry remained challenged in 2022 as external headwinds and industry immaturity hampered profitability and resulted in unsatisfying financial results… Building a sustainable, scalable, and profitable wind industry requires we continue to build industry maturity and commercial discipline.”

I’ll translate: “Wind turbines have been too dang cheap. Prices need to go up.”

In fact, they already are. The big three OEMs appear to be engaging in some degree of implicit, multilateral disarmament when it comes to pricing & product strategy.

One more important point: All of the challenges I just described are at least twice as daunting for offshore wind turbines as they are for the onshore turbines. Offshore turbine OEMs have suffered especially heavy losses in recent years; and offshore wind project developers are now paying millions of dollars to cancel power purchase agreements signed years ago, because they’re no longer sufficient to cover inflated costs.

Solar shortfalls

While the wind industry is experiencing a form of teenage angst, solar manufacturing is at risk of a much a bigger, existential crisis. Nearly every step in the global photovoltaic supply chain is dominated by China, where OEM profitability has been perenially distorted by government intervention; and more recently, according to credible accounts, by the use of forced labor. This is a very big topic, which I’m sorry to say there’s not enough room to explore much further in this post. Suffice to say that establishing an alternative supply chain outside of China would probably add to the cost of solar panels, at least in the short term. That said, incentives for domestic solar manufacturing included in the IRA already seem to be making a real difference for investment in US solar manufacturing.

Here in the US, the solar market has an entirely different profitability problem: hubris. Historically, solar project developers and asset owners have been overconfident, systematically overestimating how much energy their projects will generate.

The data in this chart comes from kWh Analytics, a specialized solar data analytics & insurance provider which has done the industry an incredible service by publishing annual reports on project performance.3 The chart shows what percentage of projects are generating less energy in a year than their owners initially estimated they’d generate in the single worst year out of a hundred, which is referred to as a“P99” generation estimate. About 17% of projects are underperforming their P99 estimates per year. In other words, those P99 estimates were very wrong.

This probably also means that solar energy has been systematically underpriced. The amount of energy a solar project will generate is one of the most imporant variables that determines the price a developer needs to set for that energy. Hence, as developers internalize the mistakes of the past, we should expect that they’ll adjust their future pricing accordingly.

Growing pain #3: Transmission constraints

Many teenagers begin to feel pent up in their childhood environments. They long for spaciousness & freedom. Renewables, too, are beginning to feel acutely confined… by the electricity grid.

As renewables have entered their teenage years, interconnecting to the grid has become more & more costly and time-consuming. Thousands of gigawatts of potential projects are now backed up in extraordinarily long “interconnection queues”, which are essentially long lines with structured processes for progression. In the US, there’s now more than twice as much theoretical power generation capacity sitting in these queues as there is total capacity online!

In addition, connecting to the grid is getting more expensive. On average, wind project developers are now spending nearly $300 per kilowatt of capacity in order to pay for the studies & local system upgrades necessary to safely interconnect. That’s about a third of the cost of a wind turbine!

The Federal Energy Regulatory Commission, or FERC, recently took steps to try to improve the process for managing these queues, which might help alleviate the problem. But ultimately, the only way to increase capacity on the grid is to increase capacity on the grid. That means more transmission lines, more transformers, more circuit breakers, more sensing & control, etc.

My firm, Energy Impact Partners, recently invested in a company that we believe can help: Infravision has developed and proven the world’s first drone-based solution for stringing high-voltage conductors, which reduces labor requirements, cost, and timelines for electric transmission construction. The company’s drones can also deploy a range of sensors on live transmission assets. That includes Infravision’s proprietary sensor & analytics suite, which enables an approach to increasing transmission capacity commonly referred to as “dynamic line ratings”.

Conventionally, transmission lines are given static capacity ratings based on conservative assessments of how much energy they can safely transmit. The goal of this static rating approach is to make sure that the thermal, mechanical, and environmental limits of a line won’t be exceeded, even in adverse conditions. The downside is that this approach ends up leaving capacity on the table.

With enough real-time data on the status of a line, however, operators ought to be able to rate their lines much more dynamically, according to actual conditions on the ground, without compromising the integrity of the system. Because static ratings are so conservative, dynamically-rated lines are in most situations able to transmit more power, most of the time. In this way, they can unlock capacity for more wind & solar to flow through the network.

Hence, I’m very excited about Infravision’s potential to reduce the cost of new transmission, and also to make the most of the lines we already have.

However, as I’ve written before, there’s only so much that any technology solution can do to facilitate the expansion of our transmission infrastructure. Unfortunately, the difficulty of building transmission is largely a problem that policymakers, regulators, and communities will need to come together to address.

Growing pain #4: Local ordinances

I need to address one more uncomfortable fact of life for teenagers: Sometimes they’re difficult to be around.

Renewables can be a little annoying, too. They certainly make a big impact on the landscape. Solar farms consume a lot of land, making it unusable for most other purposes (although “agrovoltaics” is an appealing concept). Wind turbines leave plenty of land available for agriculture, but they’re imposing physical structures which can usually be seen from miles away. To be honest, I understand people who don’t like the idea of massive turbines spinning in their backyards. (And I’m a guy with a big poster of a wind turbine hanging on the wall of my office, sitting right behind me on every zoom call.)

In the early days of solar & wind development, it was relatively easy to knock on landowners’ doors and find someone who would happily accept a lease payment to host wind turbines or solar panels on their acreage. After all, the annual lease payments on offer tend to be much higher than the value of the crops that same acreage can produce. More often than not, local governments were also happy to accept some impact on the local landscape in exchange for meaningful tax revenue. This was a good time for renewables, as landowners and local governments in the US have a lot of power when it comes to siting & permitting energy projects.

Unfortunately, we’re beginning to see local governments become less tolerant of renewables development.

Wind power in particular is facing a rapidly growing set of permitting restrictions. I suspect this is because wind turbines are simply more visible than solar panels, especially beyond the range of their immediate neighbors; and because large-scale wind project development has been going on longer.

The paper that this data comes from needs to be considered an important shot across the bow for the renewables industry. It estimates that if these sorts of ordinances were to spread across the country, the total area available for development would be reduced by nearly 90% for wind, and 40% for solar.

All of these growing pains are adding up

The renewable power marketplace firm LevelTen Energy offers the best macro view of wind & solar energy prices in the market. Their data shows that the combined impact of all these sources of teenage angst has already made a big impact, causing the average price of renewables to roughly double in the past two years.

This chart keeps me up at night. Just about everyone who cares about the climate has been counting on renewables to be the building blocks of the energy transition. Prior to the past few years, renewable power prices were nearly always falling; and most decarbonization scenarios have assumed that this trend would continue, albeit at a somewhat slower pace. But to me, none of the reasons for this sudden reversal seem like temporary speedbumps. To me, they all seem to be lasting changes to the status quo. Does anybody seriously believe we’re going to return to any the following anytime soon?

Zero interest rate policy

Global supply chains, just-in-time manufacturing, and carefree dependence on China as the “workshop of the world”

Spare transmission capacity

Rural communities welcoming renewables development with arms wide open

Please don’t get me wrong. Steel For Fuel is very pro-renewables, even though I’ve come to believe in nuclear power with the “zeal of the convert”. For goodness sake, my logo is a wind turbine nacelle being installed.

I’m not happy about the adolescence of renewables. However, I believe that adolescence tends to go much better when grown-ups try to understand what teens are going through. In the next thirty years, I still expect wind & solar to become major contributors to global primary energy supply. But in the next 5-10 years, I’m not so sure we can count on them as much as I’ve previously hoped we would be able to.

I’m also more convinced than ever that we can’t simply call these technologies “mature” and focus our energy entirely on deployment. Fundamental improvements in manufacturing and performance will be essential to putting renewables back on the right cost trajectory. (If you’re a founder in this space, let’s talk.)

In sum: I’m confident that renewables will continue growing up, but I also believe that we need to keep on nurturing them through this difficult period.

The retirement of oil

This post is already getting quite long, and frankly I need to dedicate a lot more time to understanding the dynamics at play. But for now, there are a few high-level points that I’d like to make in preparation for oil’s retirement party.

As I mentioned earlier, crude oil is the source of a wide range of hydrocarbon products. Demand for some of these products is on track to be cut back dramatically by the energy transition; for example, gasoline demand is probably already past its peak in the US, Europe, and China. But the story is more complicated for most of the other products we currently produce from an archetypal barrel of crude. I’m confident that diesel demand will also decline, but not as quickly as gasoline. Jet fuel will almost certainly last much longer. And even as we decarbonize, we’ll still need to produce all of the non-fuel products (e.g. asphalt, lubricants, and petrochemicals) which currently make up roughly 10% of the output of US refineries.

Oil refineries are by most measures the biggest and most complex industrial ecosystems in the world. They can be fairly rapidly tuned to prepare for variability in crude oil inputs, and to tweak their mix of outputs to maximize profitability. But there are no dials that can be turned to begin producing the much higher fractions of jet fuel and chemicals which declining demand for gasoline and diesel entail. Massive industrial refining complexes will require extremely careful planning & capital investment to adjust their product mix in line with shifting demand.

Hence, the refining industry will be simultaneously faced with declining aggregate demand, and the need to make major capital investments in order to calibrate its product mix. Happy retirement!

I look forward to studying this theme further, and revisiting it before too long here at Steel For Fuel.

This exchange is a bit more complicated in actual wholesale power markets. During periods of excess generation, power plants that can’t adjust their output rapidly are willing to pay to stay online. Wind power owners are willing to pay up to negative $25/MWh to keep producing power, because that’s the value of their production tax credit. The net result is that coal & nuclear plants typically end up paying into the market to continue generating, and wind plants are paid to turn off.

Vestas (Denmark), GE (United States), and Siemens (Germany)

…with data drawn from about a third of operating US solar capacity in 2021-22