The word “intermittent” comes up a lot in conversations about renewable energy and storage technology. Let’s unpack it.

Wind & solar energy is intermittent. So is energy demand, of course. And actually, so is the supply of fossil fuel…just on a very different timescale.

Energy demand varies second by second, day by day, and season by season. It’s about as predictable as the weather, which makes sense, as weather is one of its biggest drivers. Summer is reliably hot and sunny, so we know that on average we’ll consume more energy for air conditioning; next Tuesday, however, might be unexpectedly cool & cloudy, so we’ll use less than anticipated.

The supply of fossil fuel is intermittent generationally. Over the short-term – hours, days, months – aggregate supply is extremely steady & predictable. We can pinpoint the wells that our hydrocarbons will flow from tomorrow, but we’re not quite so sure about five years from now…and we frankly have no idea where our grandchildren will locate new reserves if they’re still looking. Major fossil fuel related discoveries can be decades in the making, and tend to bequeath us with decades worth of supply. This generational variability is captured to some degree in the concept of “peak oil”, especially because analysts keep on predicting it, and then we keep on finding more oil.

Historically, the energy sector has relied on the same basic solution for balancing intermittent supply and demand as any other: inventory. We have large stockpiles of coal sitting beside power plants; tanks of oil ranging in scale from our vehicles to large industrial facilities; and continent-spanning networks of natural gas pipelines paired with giant underground reservoirs. These massive stocks of fossil fuel provide plenty of inventory to handle months of variability, or big unexpected market shocks.

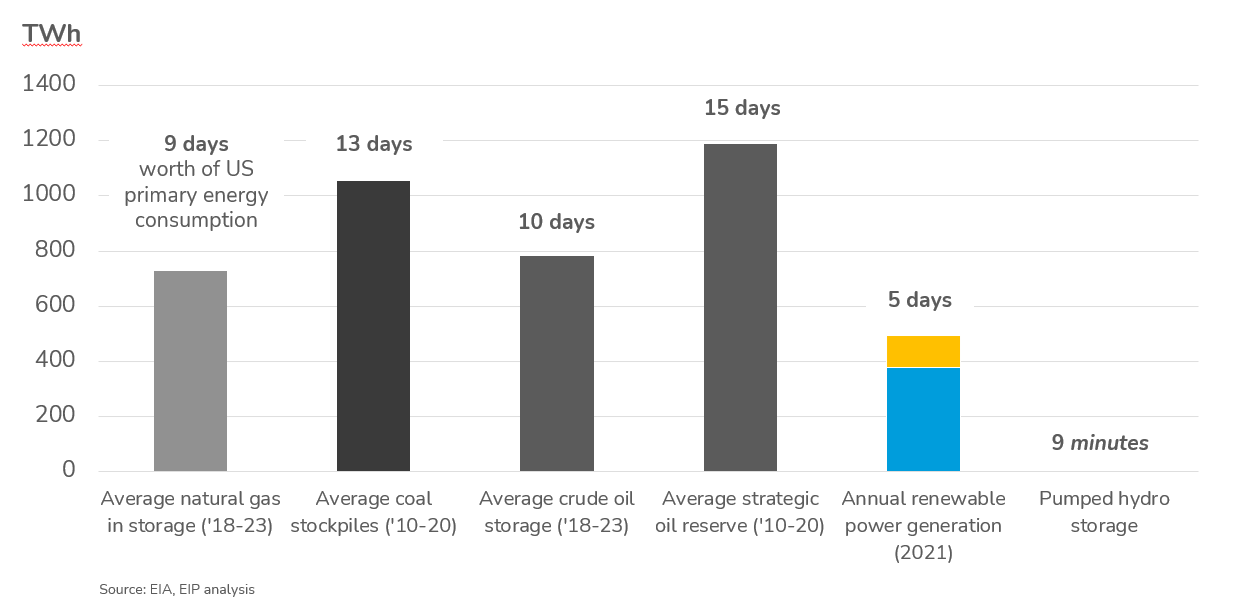

In the US, at any given time, we keep about 47 days worth of primary energy supply sitting around in caches of fossil fuel. For reference, that’s about seven times as much energy as all of the wind & solar power generated in the country in 2021.

Speaking of which…wind & solar resources have the opposite sort of intermittency problem as fossil energy. Over the course of decades they’re extremely predictable & inexhaustible. However, they’re impossible to fully predict or control over the course of seconds, minutes, days, months…even from one year to the next. At any given site, the wind resource in a really bad year can be about 40% weaker than the wind resource in a really good year.1

Unfortunately, the short-term intermittency of wind & solar has become a more pressing problem than the ultra-long-term uncertainty of fossil fuel. That’s because of some fundamental principles of electrical engineering: In order to keep electricity flowing through a circuit, the supply and demand for power needs to be almost perfectly balanced, with millisecond level precision. Too much power and fuses blow; not enough power and devices simply stop working. On the giant network of electrical circuits we’ve come to call “the electricity grid” (often simply “the grid”, for short), this means too much power can destroy sensitive equipment, and not enough power causes blackouts.

Making matters worse, electricity grids around the world have approximately zero inventory beyond fossil fuel stocks. Until very recently there was only one practical way of “storing” electrical energy at any meaningful scale, which was an approach referred to as “pumped hydro” storage. Pumped hydro is a sort of bolt-on to regular hydropower dams, which generate electricity by harnessing the force of gravity to run water through turbines. Pumped hydro consumes electricity to return some of that water back upstream of those dams, so that it can flow through the same turbines again. Occasionally we’ve even built up pumped hydro reservoirs from scratch! That said, the amount of pumped hydro storage deployed today is negligible in terms of aggregate electricity generation. It represents just about 1 hour of storage relative to our annual electricity supply here in the US.

The challenge of intermittency was acknowledged well before renewables began to be taken seriously in the mid-aughts. But initially this challenge could be pretty safely ignored, as we’d been managing similarly intermittent demand for ages. Plus, in most regions, we could still easily rely on our mammoth stores of fossil energy to balance out the natural variability of renewables.

In particular, natural gas fired power plants have been crucial to integrating wind & solar power onto the grid. If transmission is wind & solar’s best friend, then natural gas is their conservative, responsible cousin. When there’s a lull in renewable generation, natural gas plants can easily be called on to ramp up quickly and fill in the gap for as long as they’re needed. When there’s a surge in renewables, gas plants can quickly back down. Modern gas turbines were designed to operate fairly efficiently through this kind of variable duty cycle. Hence, renewables were fortunate that their early years were cushioned by a flood of cheap natural gas resources into the North American energy market, even though cheap gas also made that market much more competitive.

So to date, renewables have made the job of operating the grid a bit harder, but thus far grid operators have been able to manage without much additional cost or headache. All of their hard work has stayed comfortably behind-the-scenes…

…And in my view, this trend will continue. I don’t foresee a tipping point when renewables suddenly make grid operators throw up their hands in dismay. There’s no magical percentile at which the share of renewables will become too burdensome to manage. Instead, the cost of dealing with intermittency will just keep inching up alongside renewable energy penetration. Even those unsung heroes of the energy transition, natural gas turbines, will begin to feel the pain; as they’re called upon to operate more erratically, their efficiency will decline while maintenance costs trend up. Meanwhile, wind and solar power will need to be more frequently curtailed (meaning, wasted) during periods when there’s simply more supply than demand. In certain seasons, typically spring & fall, curtailment will become a near-daily occurrence. Most concerningly, there will also be periods of several days at a time when the sky is cloudy, the air is still, and renewables are missing in action.

None of these trends mean we’ll absolutely need storage, but all of them will make storage a more & more attractive economic opportunity. I believe there are at least four classes of storage technology that are on track to take advantage of this opportunity.

So, here's four ways to store sunlight...2

Way to store sunlight #1: Lithium-ion batteries (or, perhaps, some derivative thereof)

In the 2010s, a handful of power project developers and grid operators realized that the nascent electric vehicle industry was presenting them with an opportunity: they began riding the coattails of rapidly falling EV battery costs, by experimenting with lithium-ion batteries as a form of grid storage. At first, these developers were literally hooking up a bunch of EV battery packs to the grid, as you can see in this slide from a 2014 presentation by one of the early leaders in this space, AES:

Initially, lithium-ion storage was used almost exclusively for very short-term power balancing applications – charging & discharging in short bursts, every few seconds, in order to regulate the stability of the grid in real time.3 Batteries were quickly found to be a cost-effective substitute for using natural gas & steam turbines to perform this feat, because a small amount of battery storage in this application goes a long way. Batteries with just a half hour of storage (or less) could easily serve as moment-to-moment buffers for the grid. But the market for this service is tiny in the scheme of the overall energy system. It amounts to just about 1% of the power generation capacity required to satisfy peak energy demand.

There’s a bigger market, though, which is already opening up to lithium-ion battery projects. Nearly every power system already experiences fairly regular spikes in "net load", which is shorthand for total power demand net of renewable power supply. Once or twice a day there's a spike in electricity demand, or a shortfall in renewable supply, or both, which lasts for about 2-6 hours. A classic example that's purely driven by demand is the UK's "kettle surge", when millions of Britsh tea drinkers reach for their electric kettles shortly after the end of popular TV shows. A more troublesome, emerging trend is the evening confluence of sunset with a deluge of electric vehicle charging, as EV drivers plug in their vehicles upon returning home from work…just as solar power generation disappears.

For two reasons, addressing these especially peaky peaks is a super high value appliction for storage. First, these periods yield the best opportunity for energy price arbitrage. Storage systems can ‘charge’ during the absolute lowest energy cost hours of each day (which, in some cases, might actually be zero-cost hours due to surplus renewable generation); and they can then turn around and sell that energy back to the grid during the highest-priced hours.4

Second, storage units can be valued & compensated as "capacity resources", which simply means they’re available to provide power when the grid needs it - charged & ready to satisfy these slivers of peak demand, whenever they arrive. As a rule of thumb, four hours of storage can be confidently relied upon to address the top 3-5% of peak demand in any given electricity system - and can be compensated for that service. That’s in the ballpark of 30 gigawatts of storage capacity in the US, which represents $30-50 billion worth of investment.

Lithium-ion batteries are going to be tough to beat as the storage solution of choice for these sorts of daily “peaking” applications. Sure, they have all kinds of problems - notably major supply chain vulnerabilities and safety concerns - but they’re proven, relatively affordable, and will continue to benefit from progress driven by the EV sector. We’re also getting much better at operating & maintaining them thanks to the efforts of companies like Zitara (in the EIP portfolio). Most importantly, the art of grid storage “system integration” has become much more sophisticated in just a decade since AES began stringing together EV battery packs. My firm, EIP, has invested in another of the world’s top storage system integrators, Powin Energy, and this is what their fully modular, built-for-purpose lithium-ion solution looks like:

So, my take is that lithium-ion is tough to beat, but it's not unbeatable. Find me a storage system that can achieve a total installed cost of $150-200 per kilowtt-hour; round-trip efficiency of at least 70% AC-AC; a useful lifetime of at least 3,000 cycles; made from abundant materials; with a superior safety profile to lithium-ion; and a relatively low capital-intensity manufacturing process5…and I'll concede it has a chance to squeeze lithium-ion out of the lower-duration end of the grid storage market.

More likely, though, I believe pretenders to lithium-ion’s throne are underestimating how much progress might still be wrangled out of lithium-ion and its enormous supply chain. For example, in the past three years there has been a marked shift in grid storage systems away from lithium-ion variants using cathodes made from high-cost nickel & cobalt, and towards cathodes using safer, more abundant, less expensive iron-phosphate. Now sodium-ion, which is a close cousin to lithium-ion in many ways, is beginning to be commercialized. It’s heavier than lithium-ion, but grid storage isn’t so fussy about weight as vehicles, and it’s less than half the cost at the level of the battery ‘cell’.

A growing opportunity for diurnal (day/night) storage

As renewable power penetration edges into the 40-60% range, which I’m confident it will in many regions, we’ll begin to encounter regular, extended periods of surplus renewable power, and reciprocal periods of scarcity, over the course of most diurnal cycles. The upshot is that the opportunity for energy price arbitrage will become richer, for more hours, every day.

Even presented with this rich arbitrage opportunity, however, most storage projects will still need to be earn revenue from providing firm, reliable capacity. But, with the peakiest peaks already snipped off by 4-6 hour storage systems, the remaining opportunity for storage will be mostly driven by diurnal factors which last for 12-16 hours. Put another way: the next tranche of storage will probably need 12-16 hours of storage in order to address a meaningful share of the new ‘net peak’ (the peak that’s left over after the first tranche of storage has gone to work). Adding more storage beyond that duration yields rapidly declining marginal value; past about 20 hours there’s practically no value at all…until you enter a whole new realm of multi-day storage at around 100 hours (which I’ll get to in a minute).

My own rough assessment is that the opportunity for 12-16 hour storage will be about three to four times as large as the opportunity for 4-hour batteries - growing to 10-15%, perhaps as high as 20% of the share of firm, reliable capacity needed in the power system...as long as it can be made cheaply enough.6

And there’s the rub. For lithium-ion storage systems, adding more hours of storage basically just means adding more batteries, which means adding a lot more cost.

Storage math interlude! (back-of-the-envelope edition)

Currently in 2023, a fully installed lithium-ion grid storage system costs about $300 per kilowatt-hour, all in.7 Four-hour systems tend to cost a bit more per kWh; longer-duration systems a bit less. There are big error bars around this number, yada yada…

So today, lithium-ion storage systems cost somewhere in the vicinity of:

~$1,200 per kilowatt for a 4-hour storage unit

~$3,600 per kilowatt for a 12-hour unit

Meanwhile, a natural gas combustion turbine which offers unlimited hours of generation capacity typically costs in the range of $700-1,000 per kilowatt for a fully loaded power plant.

There’s a few important wrinkles: Gas turbines never degrade and they’re built to last for at least 25 years, while lithium-ion batteries last for 10-15. Plus, storage resources are inherently harder to plan around and dispatch effectively.8 On the other hand, batteries can earn more profit from day-to-day energy arbitrage than gas peakers can earn from firing up during peak hours.9 As renewable penetration increases, this arbitrage advantage will tip the scale towards storage.

The result is that grid storage is already becoming [hand-wavy] competitive with natural gas turbines for sniping at four-hour peaks. But lithium-ion batteries are around 4-5X too expensive to compete with gas for diurnal grid balancing applications. Even in a tightly carbon-constrained world, it's hard to imagine paying 4-5X the cost of natural gas power capacity for storage resources.

My view is that attractive solutions for diurnal storage need a path to undercut lithium-ion systems today by about 50%. That’s a fully installed cost of $150/kWh or lower. Frankly, at this point, I don’t get all that excited without seeing a path to $100/kWh, and I think $50/kWh is what’s ultimately necessary to turbocharge the market. However, I’ll readily admit that I’m a jaded old storage grump who’s heard too many pitches from novel tech companies, and then watched those companies get crushed into the ground by the juggernaut of lithium-ion.

So, how do you get to $150/kWh of storage? Even better, how do you get to $50?

Way to store sunlight #2: Heat

The answer is heat. You store energy as heat.

There’s a bunch of absolutely dirt-cheap materials that can absorb a lot of heat: rocks, bricks, carbon. I’m sure there are more. These materials all cost in the ballpark of $5 per kWh of thermal energy that they can store. That’s a great starting point for building a total system which costs less than $50 per kWh!

The world already has a handful of full-scale heat storage systems deployed commercially today. These systems are all heated directly from concentrated sunlight, as part of large “concentrated solar power” facilities, like this one, and they all use what’s referred to as “molten salt” as a thermal storage medium.

There’s a few reasons why molten salt stalled out after some early momentum in the mid-aughts. First & foremost, the “salt” we’re talking about here isn’t table salt; it’s a blend of toxic, corrosive chemical salts. These salts are relatively cheap from a material cost standpoint. However, they’re difficult to permit; they require complex, expensive systems of pipes, pumps, and tanks; and the salt really does need to be kept molten at all times, or the whole system will break. Hence, molten salt storage is now notorious for being difficult to operate safely & reliably.

I once heard, second-hand, a quote from a power plant operator who’d worked on a molten salt storage project: “That project alone made my company stop trying anything innovative for about a decade.”

So, interest in molten salt mostly tailed off in the early 2010s, but there’s been a resurgence in alternative approaches to heat storage. This new wave of solutions differs from molten salt in two ways: most employ solid thermal storage media, and most are intended to be charged up with clean electricity, rather than direct concentrated sunlight. (This is an extraordinary testament to how affordable solar photovoltaics have become.)

The most promising of these solutions I’ve encountered, which we’re now investors in at EIP, is Rondo Energy. Rondo’s solution, as my colleague Greg Thiel is fond of saying, is “just complex enough”. Picture a giant insulated box filled with bricks that heat up to over 1,000 degrees Celsius. It’s an extraordinarily elegant approach, utilizing resistance heating elements similar to those you’d find in a toaster, plus an ultra-cheap class of thermally-dense brick that’s been employed for over a century in blast furnaces at steel mills. There’s nothing remotely toxic or exotic, relatively few moving parts, and as of March 2023 the company has commissioned the first of these systems in a real commercial application in California.

Now that’s what I call an exciting diurnal storage solution.

What’s especially exciting about heat storage is that it can operate in two modes: power-to-heat, and power-to-power.

In power-to-heat mode, electrical energy from solar panels or wind turbines is converted via resistance wires into high temperature heat. That heat can then be dispatched on-demand to fuel any industrial process which needs it (which is…most industrial processes). The round-trip efficiency of this cycle is startlingly high - upwards of 98% from solar or wind power input to heat output - because, of course, energy loss is heat. Typically in this mode, zero-carbon heat from a Rondo unit would displace heat from fossil fuel furnaces or boilers. Hence, it’s a one-two punch for decarbonization: clean electrification and storage delivered as a single, hyper-efficient solution.

In power-to-power mode, heat that’s stored in a Rondo unit needs to be converted back to electricity, somehow. The easiest way to do this is to run that heat through a steam turbine. The world is going to have plenty of steam turbines sitting idle as we retire coal-fired power plants, many before their natural end of life. Thermal storage can essentially ‘repower’ this type of site by replacing a coal-fired boiler. Conveniently, these sites also tend to come with communities of workers who know how to operate the key equipment, plus an existing high voltage grid interconnection.

The only downside of converting heat back to power is that it’s an inefficient process. More than 60% of the energy stored as heat will be lost on its way back to power in a steam turbine cycle. But…given that a lot of the energy we’re likely to store in this type of system will be otherwise curtailed wind or solar power anyway, that kind of inefficiency is surprisingly tolerable. Also, there are some clever new ways of producing power from heat in the works.

There’s actually a third option, combined heat & power, which combines some of the best features of power-to-heat and power-to-power storage cycles. But that gets complicated. If you want to learn more, you should really reach out to the smart people at Rondo.

Way to store sunlight #3: Form Energy

Rather than use a generic term like “metal-air batteries” or even more specifically “iron-air batteries”, I figure I’ll just cut to the chase. Form Energy, another of our portfolio companies at EIP, is the only company I’m aware of that’s cracked the code on multi-day, self-contained, power-to-power storage. Their solution is an electrochemical system that’s been described in lay terms as “controlled rusting and de-rusting”. It’s on track to achieve a total installed cost below a tenth of lithium-ion today.

Form’s only significant downside is that it’s not a very efficient storage solution; round-trip efficiency is likely going to fall in the range of 40-50%. But as I discussed above, efficiency isn’t nearly as important in scenarios with high levels of wind & solar generation, in which a lot of the energy input to a storage system would otherwise need to be curtailed. This is especially true for the category of storage that Form essentially defined, which is “multi-day”. Form’s first product can hold nearly four days of energy, to be specific. And of course, all those extra hours are unnecessary for diurnal cycling. They’re only intended to be used once or twice a year, and their sole purpose is to provide firm, year-round capacity.

Why four days? It just happens to be the case that almost no matter where you are in the world, that’s the amount of storage you’d need to confidently ride through occasional periods of especially low wind & solar output. One of the reasons I know this is that Form, in addition to being a technology developer, has also assembled one of the best energy system modeling teams in the industry. Across a range of distinct regions with diverse renewable resource profiles, they’ve been able to construct theoretical portfolios of wind, solar, lithium-ion batteries, and their own 100-hour storage resources which could match the reliability of today’s grid. In regions with low cost renewables (and if Form can hit its cost targets), these systems could also match the cost of today’s grid.

Here’s some outstanding data visualizations highlighting the opportunity for multi-day storage. These come from a fresh study by Form and one of their first customers, Great River Energy in Minnesota:

Now, if you follow my writing on the energy transition, you’ll know I’m skeptical of the view that we’re headed towards a fully renewable power grid - at least, not in aggregate. I believe other constraints - namely siting & permitting challenges for renewables themselves, and for electric transmission - are going to become a bottleneck before multi-day intermittency.

So you might be asking: What’s the point of multi-day storage, if we’re not heading towards a 95%+ renewable power system?

There’s a few points.

First, let’s say we only reach 50% renewable power generation, and our remaining need for electricity is satisfied by so-called “baseload” resources like nuclear power. At the right price, multi-day storage would be a cost-effective tool for enabling baseload resources to run the way they want to be run…which is flat out, all the time. Nuclear, geothermal, and fossil fuel with carbon capture & sequestration each fit that description. They’re all extremely capex intensive, so they don’t make sense to build for infrequent utilization. Also, these resources are not known for their operational flexibility; they cost a lot to start & stop all the time, primarily due to reduced efficiency and increased wear & tear.

Second, just because we don’t end up reaching ultra-high levels of renewable power generation everywhere doesn’t mean we won’t reach those levels anywhere. For example, I have a bunch of friends & colleagues in Oklahoma, which is the kind of place where we could probably build out all of the cheap renewables we need to generate zero-carbon power without a crazy amount of new, long-distance transmission lines. Multi-day storage like Form could allow Oklahoma (and Kansas, and North Dakota, etc…) to fulfill this potential, even if wind exports from these renewable powerhouse states are ultimately capped by a lack of transmission.

Lastly, multi-day storage can make sense as the foundation of a distributed “microgrid”. Deployed next to a data center, or a rural hospital, or a university campus, or some other large energy consumer with a bit of extra land nearby…a Form system could provide essentially the same level of resilience as a diesel backup generator. Unlike a diesel generator, however, Form has zero direct emissions, so it can also be used as a grid storage resource during the 99.97% of hours that the grid is up and running.

I’m very bullish on the concept of deploying distributed storage in this kind of double-duty setup. That said, microgrids are also an ideal setting for distributed, flexible natural gas generation. In most places in North America, natural gas generation is probably going to remain cheaper than storage as a multi-day grid balancing resource, and microgrids are one of the highest value applications for a small amount of natural gas combustion. (EIP portfolio company Enchanted Rock has built hundreds of megawatts of this sort of microgrid.)

Way to store sunglight #4: Hydrogen

Let’s say the combination of lithium-ion batteries, Rondo, and Form can collectively address all of the world’s budding intermittency issues, up to about four days.

What about the remaining 43 days of primary energy we currently store in coal piles, oil tanks, and gas reservoirs?

Call this “strategic” energy storage; and one possible answer is that we don’t really need it. In a fossil fueled world, we keep it around because A) storing coal in a giant pile is a ridiculously cheap way to store energy; B) huge oil tanks and gas reservoirs are also pretty cheap at scale, so they just make economic sense; and C) fossil fuel supply is at risk of irregular disruption caused by weird outlier events - e.g. a train derailment (which could set back a coal-fired plant by a couple weeks), or a war (which could have extraordinary consequences for oil supply).

But in a theoretical future world with nearly all primary energy supply domestically controlled, and a robust electric transmission system built for multiple contingencies, it’s fair to ask: Do we really need those extra 43 days of reserves?

Personally, I find this answer unsatisfying. National security strategy is above my pay grade. However, I’m familiar with the phrase “unknown unknowns”, and that strikes me as sufficient rationale for keeping about a month & a half of energy on hand.

There’s basically only two reasonably affordable ways to store that vast quantity of renewable energy: 1) As hydrogen, underground; and 2) As molecules that are, energetically speaking, derivatives of hydrogen.

The basic idea here is to use renewable power to split water into hydrogen & oxygen through a process called “electrolysis”, which is done using “electrolyzers”. Electrolysis is a well-established process; actually, it’s a bunch of well-established processes (and a bunch that are still under development, too). Until very recently, however, the market for electrolyzers has never been more than a rounding error in the massive market for hydrogen, which is already consumed today as a commodity feedstock for ammonia, methanol, and petrochemical production. At present, nearly all of this hydrogen is made around the world by stripping hydrogen molecules from hydrocarbons, and emitting the leftover carbon.

I want to emphasize just how much hydrogen we already make today. Although we don’t currently use this hydrogen as an energy resource, we produce it in quantities that are relevant in the context of strategic storage.

The challenge for electrolysis is that current, established electrolyzers are simply too expensive to make hydrogen affordably. At EIP, we’ve invested in Electric Hydrogen, which has built on proven principles to create a much lower-cost electrolysis package, for the cheapest possible clean hydrogen production.

Hydrogen deserves it’s own posts, and I promise it’s going to get them here at Steel For Fuel.

For now, though, I’m going to focus on hydrogen’s role as an energy storage medium.

I’ll start by warning you that this is not a pretty picture.

Separating hydrogen from oxygen consumes nearly a third of the energy input to the electrolysis process. The remaining 70% or so is embodied in the resulting H2 molecules. That’s a big efficiency hit, right off the bat.

And then…you have to do something with that hydrogen, which is tougher than it sounds because hydrogen is what laypeople might refer to as a “pain in the ass” molecule to work with. At least, so says everybody I’ve ever met who’s actually worked with hydrogen. I quote: “Hydrogen simply does not want to stay contained”. So, it’s hard to envision a scenario in which you don’t lose at least another 10-20% of your primary clean energy in the process of compressing and pumping hydrogen to transport it, store it in an underground reservoir, and later retrieve it.

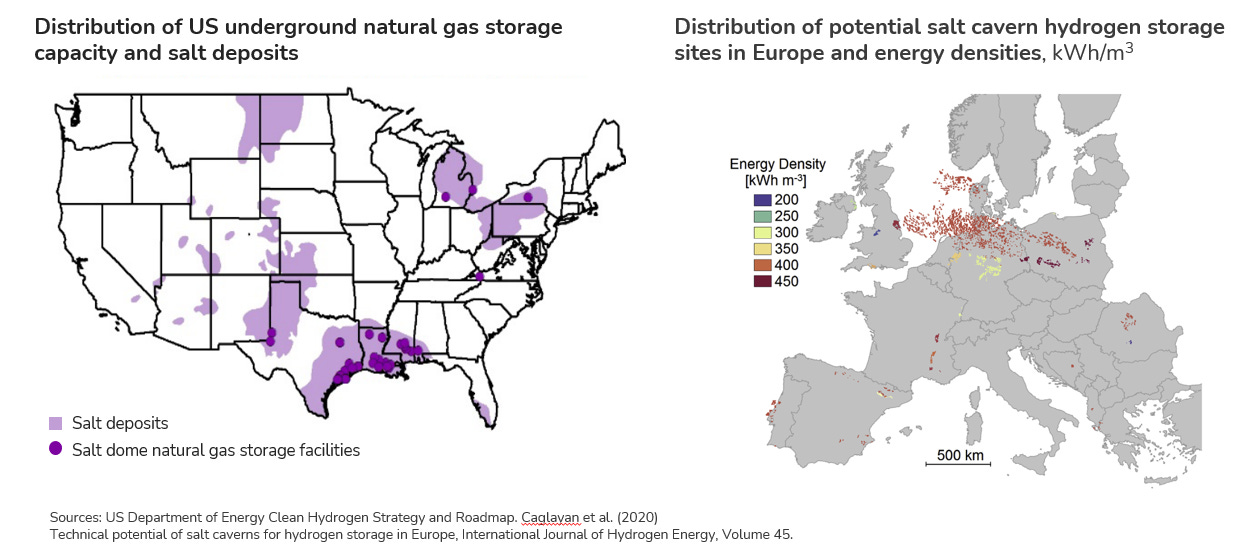

There’s another issue. Hydrogen is much less energy-dense, volumetrically, than natural gas. At ambient pressure, H2 contains just about a third of the energy per liter as natural gas. The only place to store large volumes of it affordably is undergound, and we only know of a few locations where the geology is just right for that kind of storage today.

Lastly, hydrogen takes another big efficiency hit as a medium for full power-to-power storage cycles. In a best case scenario, running hydrogen through a fuel cell or a combined cycle gas plant will generate power with about 55% efficiency. In a more likely scenario, combusting hydrogen in a simple cycle gas turbine will result in about 35% efficiency.

The upshot is that round-trip, power-to-power efficiency for hydrogen storage will be in the range of 20-35%. Recall that lithium-ion storage systems are currently achieving ~85% efficiency, and even Form, at the low end of the battery storage range, is targeting 40-50%.

And all of this requires at least tens of billions of dollars in dedicated infrastructure investment. I mean “tens of billions” quite literally, as I think that’s the minimum spend that’s required to create a viable, regional hub for clean hydrogen. Certainly, nothing less will really do for hydrogen as a meaningful energy storage solution.

…

This might sound like a terrible start for an energy storage medium, and…it is. I’ll admit that these downsides initially made me a big skeptic of employing hydrogen for storage.

And, frankly, hydrogen’s operational challenges still have me convinced that it’s not going to be cost effective to do much of anything with at small scale, including to store it. At very large scale, however, I’ve become more confident that those “pain in the ass” challenges are solvable. I’ve come to see four key benefits working in hydrogen’s favor, which I believe might be enough to overcome its obvious weaknesses.

It’s probably going to be extraordinarily cheap to store very large quantities of hydrogen underground. Setting aside the cost of producing hydrogen in the first place, the marginal cost of setting up a giant underground storage reservoir is just a few dollars per kWh, which you’ll recall is on the order of 1% of the capex of a lithium-ion system.

Decarbonization will require us to make vast amounts of hydrogen regardless of its role as an energy carrier, because it’s an irreplacable feedstock molecule for essential chemical building blocks. Any large-scale use for hydrogen will eventually need large-scale hydrogen storage. So, my view is that we’re going to be building out a lot of the foundational infrastructure for producing, transporting (via pipeline), and storing hydrogen underground in almost any decarbonization scenario.

The natural gas turbine fleet is being primed for retrofit in order to run on higher blends of hydrogen, whenever it becomes necessary or economically viable to do so. New gas turbines installed in the next five years will practically all have the ability to consume about 10-18% hydrogen (by energy content) blended into their fuel injection stream. More importantly, the big three turbine OEMs are promoting systems which are ‘retrofit-ready’ for higher blends, even up to 100% hydrogen, by 2030.10

Grid operators are going to need gigawatts of new, firm generation capacity in the next 3-7 years, before they’re comfortable deploying next-generation storage technology at gigawatt scale. I personally spend a good deal of my time hanging out with grid operators, so I’m especially aware of how much validation they need to build comfort in assets that are critical to grid reliability. However, I also know they’re increasingly concerned about investing in new assets which might be decarbonized out of a job before they’re fully depreciated.

For operators with an acute need for capacity in this near-term timeframe, so-called “hydrogen-retrofit-ready” natural gas turbines are proving to be an attractive option. These assets offer an unsually high level of ‘option value’ in the scheme of big capex investments in the power sector.

Lastly, hydrogen-to-power is no longer just theroetical. In Utah, a consortium led by Mitsubishi Power Americas & Magnum Development is developing a large electrolysis & salt cavern storage project intended primarily for gas turbine blending. The US Department of Energy has put a big stamp of validation on the project with a half a billion dollar loan guarantee.Hydrogen could be much more than just a power-to-power storage medium. Most large, industrial facilities could hypothetically be prepared to blend modest amounts of hydrogen into their fuel mix; down the road, they might also be retrofitted for pure hydrogen combustion. Hence, hydrogen is a uniquely flexible energy storage medium, as the right infrastructure could enable any molecule in storage to be deployed to an array of different consumers. (This concept is referred to by energy system wonks as “sector coupling”, and it’s guaranteed to get a room of them all riled up.)

Not yet convinced? Still too much of a pain in the ass? Consider that hydrogen molecules can be further tamed by upgrading them into much more energy-dense derivatives, which also happen to be big global commodities with existing markets.

For example, three hydrogen molecules plus a nitrogen molecule makes two ammonia molecules: 3 H2 + N2 = 2 NH3. About 90% of the energy input to this equation is embodied in the hydrogen; in other words, once you’ve made the hydrogen, you’re energetically most of the way to ammonia. To be clear, ammonia has its own set of “pain in the ass” types of problems; but it’s a pretty dang efficient next step for hydrogen, and it already has its own giant market with pipelines, storage tanks, and shipping vessels operating today. This is similarly true for methanol (CH3OH) - and shockingly, that’s probably going to be the case even if the carbon atoms in that methanol need to be captured out of ambient air to be truly carbon-neutral.

So, to sum up: I don’t foresee hydrogen taking over the whole grid storage market from more efficient options, such as lithium batteries. However, hydrogen’s role as a form of common currency between energy and other commodity sectors means that it will at least play an implicit role in balancing the aggregate energy system. And, I’m becoming convinced that bulk power system storage will be a ‘spillover’ application for all of the hydrogen infrastructure that we build initially for other reasons. Hydrogen will probably compete at the margins with other multi-day, and to a lesser extent diurnal storage options.

A bonus fifth way to store sunlight: Natural gas

Bet you didn’t see that coming!

Natural gas, like all fossil fuels, is made from stored sunlight, too. (If it helps, think of it as a form of inter-millenial storage.)

I’ll be talking about natural gas a lot more in future posts. For now, as a preview, I want to make just three points:

Continuing to burn natural gas, if we do it right, is fully compatible with achieving net-zero carbon targets. We can employ either direct carbon capture & sequestration, or indirect carbon removal strategies to abate the emissions.

CCS, whether direct or indirect, is expensive. I can’t imagine any net-zero scenario in which our use of ‘fossil’ gas doesn’t decline by a whole lot. However, preserving a small amount of gas in the system can go a long way towards containing the cost of the energy transition.

I’ve personally come to view natural gas as the least dispensable fossil fuel. That’s not true in every application in which we consume gas today, but there are a few applications in which fully transitioning away from gas appears especially expensive. One of those applications for which gas has a distinctively low cost edge is fueling the long tail of hours necessary to ensure 24/7 reliability of the energy system, through thick & thin.

Towards a clean, reliable energy system

While we might not exactly replace the 47 days of fossil fuel inventory we tend to keep on hand in America today, I’m pretty confident that energy storage solutions will allow us to create an energy system that’s just as reliable, resilient, and secure. (Perhaps, even more so.) As all of the storage solutions I’ve described in this post are more or less on the cusp of commercialization, this is not a far future hope. This is happening here & now, and these aren’t the only four (five!) solutions, of course; there will surely be a few more that make it through the gauntlet of early-stage technology development & commercialization. We’re lucky to be living through the inflection point for grid storage.

And wind! (“Four ways to store sunlight” was just a catchier title)

When you turn on the lights, or your gas stove, you want energy immediately. Today, our fossil fuel infrastructure often provides this service without being explicitly paid for it. It’s simply assumed that a combination of pressure in gas pipelines and inertia in big heavy, rotating turbines will take care of millisecond-to-millisecond fluctuations in supply & demand. Beyond those first few moments, in electricity markets, power plants are also compensated for what’s referred to as “ancillary services”, meaning they’re ready & willing to ramp up or down quickly, within seconds to minutes of a signal from a grid operator. The ancillary service known in the US as “frequency regulation” typically requires an automatic response within 4 seconds. There are also services for “spinning reserves”, which are able to ramp up fully within 10 minutes, and “non-spinning reserves” which need to be ready within 30 minutes.

In fact, today, energy prices in the US are often negative, as wind farm operators will pay up to $24/MWh to keep producing power, because that’s the value of federal tax credits they miss out on when they curtail their output. Coal & nuclear plant owners might also be willing to pay to keep their boilers churning, as it’s operationally costly to turn down for short periods.

…ideally, repurposing existing lithium-ion battery manufacturing equipment and facilities.

3-4X growth in terms of installed power capacity (GW)…much higher growth in terms of installed energy capacity (GWh).

This is a pretty optimistic cost for usable storage capacity in 2023. I say “usable” capacity, because lithium-ion batteries are unsafe to fully charge or discharge, and they degrade faster if they’re regularly discharged below even 20% of their full ‘depth’. Additionally, they degrade over time no matter how they’re operated, which means storage systems need to be oversized on Day 1 to ensure that they still have sufficient capacity to do their job on Day 500, etc.

If you have a natural gas combustion turbine, you can fire it up when you need power, for as long as you need power. If you have a battery, you need to do all kinds of sophisticated modeling to make sure you reserve enough charge for the periods of net peak demand.

“Profit” in a competitive energy market = “Value” in a fully regulated, vertically-integrated utility context.

The “big three” = GE, Siemens, Mitsubishi

Could Rondo energy achieve much better outcomes by using heat pumps to create the heat they store? They are running during the day when COPs are best, let’s say 2.5 COP conservatively. That’s 250% kWh to heat stored * 40% heat to power = 100% of kWh in during the day to kWh out during the evening. Yes there’s a bit of heat loss in storage but also sometimes COPs are even 3+ so 2.5 feels good enough for back of envelope.