The Age of FFOAK and The Better Mousetrap Fallacy

The end of the beginning for climate tech, Part 2

In Part 1 of this series, I made the case that the weird mashup of a community and a sector that's come to be labeled "climate tech" has reached the end of the beginning.

In this post, and the next one, I want to share some additional perspective on the implications of this transitional moment. This post will focus on hardware — especially “deep tech”, which pushes the boundaries of science & engineering. The next post will focus on software.

But I want to start by rewinding, because there are some important lessons to be learned from the past couple of decades.

Building the building blocks

When was the beginning of the beginning of climate tech? Although the phrase itself is barely five years old, I’d suggest that the sector actually dates back about twenty years. In retrospect, 2004 seems like a reasonable starting point. That was the year Vestas acquired NEG Micon to become the world’s largest wind turbine manufacturer, amidst the first real spate of climate tech M&A — which birthed the modern wind power industry.

Around the same time, the venture capital market began dabbling in what’s retrospectively referred to as “Clean Tech 1.0”. This initial round of venture capital flowing into the sector produced a few relatively modest financial winners — e.g. Nest, Sunrun, and Enphase — but only one truly transformational company: Tesla. There were also plenty of storied failures, particularly in solar manufacturing and battery technology. The venture capital industry soon turned its attention back to building the internet, which was way, way more profitable.

Hence, for most of this period, venture capital was not a particularly important driver of innovation in climate tech. The defining forces of innovation in this era were not “Aha” moments in academic labs or proverbial startup garages; they were economies of scale and learning curves. The defining actors were mostly big corporations iterating on existing technology, then manufacturing and deploying it at progressively larger scale: first wind turbines, then solar panels, then lithium-ion batteries and electric vehicles.

Of course, complicating matters, the most important actor of all during this period was probably the People’s Republic of China. I’ve written previously about the playbook adopted by the Chinese government, which was honed on solar, then applied to batteries:

Increase manufacturing scale by about 1,000X.

With every new factory, iterate just enough on the product in order to maintain steady performance improvements.

The upshot of this activity is that the world has become tremendously reliant on a single nation for what are probably the two most important building blocks of the energy transition. This is clearly a major risk factor, which I plan to address in more detail in a future post. Nevertheless, the fact that the biggest questions about solar and batteries are no longer technoeconomic, but geopolitical, is an encouraging milestone. These products work well. They’re reasonably affordable. And they’re ready to be deployed by the terawatt.

The same is true for wind turbines, which are thankfully much less dependent on Chinese supply chains. It’s also true for a handful of additional, established technology categories that have been spruced up and repurposed for new energy transition applications — most importantly, heat pumps for heating (no longer just for cooling), and electric motors for vehicle propulsion. And of course, we also have legacy solutions that work well enough in two additional areas — the electricity grid, and nuclear fission — which are primarily constrained by policy & regulatory factors rather than by technoeconomics.

But of course, despite all of the progress we’ve made on many of these foundational building blocks, it would be foolish to think that they’re all we need to get the job done.

Even the most mature technologies still face major headwinds. Solar & wind power, for example, have become increasingly encumbered by a slew of growing pains in a number of key markets. There are major regulatory obstacles to rapidly expanding the electricity grid. Heat pumps will eventually bump into a winter peak demand problem. Etc.

Moreover, many of the biggest remaining gaps along the path to global decarbonization are simply not addressed by our slate of mature technology. For example, there is unfortunately no combination of solar panels and batteries that can realistically decarbonize shipping or aviation. The list of problems for which we don’t yet have an affordable solution we can count on is still too long.

The return of venture capital

That brings us to the last five years, give or take, when venture capital came surging back into climate.

I wish I could fully explain what happened during this period. As in every rennaisance past, it was the serendipitous confluence of multiple factors which opened the floodgates of investment & entrepreneurship — this time into climate tech, especially “deep” climate tech.

I suspect it had something to do with venture capitalists staring into the abyss at the end of the internet; while some investors wandered into a “web3” rabbit hole, others decided to try their hand at building transformational hardware.

Simultanously, there was something in the water during this period (maybe covid?) which prompted hundreds of big corporations to amp up the ambition of their carbon commitments… which in turn increased investor confidence that there would be a market for much more ambitious technology. By the peak of the market, just before the end of ZIRP, the world’s largest asset manager made a pretty bold pronouncement about our sector.

Fortunately for all of these new investors hunting for opportunities in climate tech, this period was also marked by an abundance of talented founders. It turns out that a lot of the smartest young people coming out of engineering & business programs these days are very concerned about climate change, and have decided to do something about it. Hence, climate tech is absorbing an inordinate share of the top technical and commercial talent of the current generation of 20 to 40 somethings. (And plenty of 50 and 60 somethings, too!)

Plus, ARPA-e was launched in 2009. Ten years later, many of the seeds that this program planted were finally beginning to bear fruit… all at once. (I’m happy to rant to anyone who’ll listen about how ARPA-e has been the most effective government program of my lifetime.)

Whatever the causes of the climate tech boom, the results have been extraordinary: a cambrian explosion of promising solutions spanning just about every nook and cranny of the economy in which carbon is emitted. We now have a cornucopia of interesting technology pathways to pursue in all of the most obvious sectors, and many of the less obvious ones, to boot.

That brings us to the present day, where we see a small but meaningful fraction of this cohort emerging as early leaders in their fields — boasting attractive fundamental cost profiles, technical validation at relatively modest scale, and management teams with an early track record of execution.

Entering the Age of FFOAK

Now, of course, there’s only one way to determine how these early leaders perform at much larger scale, and how steep their cost curves turn out to be: Scale them up!

In other words, the next step is to build big, honkin’ first-of-a-kind facilities — which now go by the acronym “FOAK”. In fact, because learning curves generally require building more than one of something, these companies usually need to be able to raise capital for their first-few-of-a-kind, or FFOAK.

I’m afraid that’s easier said than done. FFOAK has turned out to be an especially tricky stage of climate tech to finance.

I’m obviously not the first person to highlight this problem. It’s the talk of the climate tech community these days. Breakthrough Energy has spun up an entire program focused on it. Unfortunately, I don’t think anybody has really cracked the code — at least, not in a scalable, sustainable manner. As my colleage Shayle Kann has pointed out in multiple forums, FFOAK financing is hard for a reason. The pitch for investors tends to be a tough sell: “Technology scale-up risk with infrastructure returns!” Plus, this stage is simply too capital intensive for most funds to be able to assemble a sufficiently diverse portfolio to manage their exposure to individual projects.

I wish I had a better answer to this problem, but instead I’ll just offer a couple of predictions:

The very best climate tech companies will figure this out. They already are! Between government funding, semi-philanthropic capital, and other creative approaches, the cream of the crop will be able to piece together the financing they need.

However, this was always going to be a stage at which the capital funnel narrowed significantly; and the end of ZIRP has made made it even narrower. There will be some good companies who, by all rights, deserve a chance to prove their technology at larger scale, and are just not going to get that chance.

Hence, the Age of FFOAK is also going to be an Age of Winnowing.

Beware the Better Mousetrap Fallacy

Just because capital is scarce at the FFOAK end of the climate tech funnel has not prevented investors from continuing to pour more money into the top of the funnel.

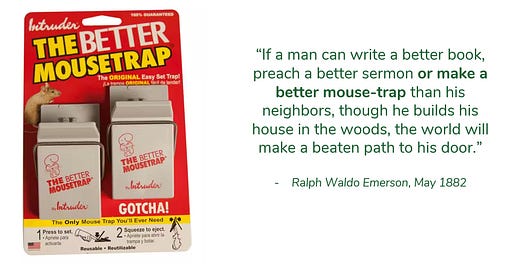

Seed stage investment in climate tech has held remarkably steady, which I think is mostly a good thing. There are, after all, lots of big gaps left to fill on the long & winding road to net-zero carbon. There are plenty of proverbial “better mousetraps” we might still be able to build to overcome previously intractable obstacles.

Maybe.

In some cases, the stubborn view that there must be a better mousetrap to solve our problems can become counter-productive. I’ve come to think of this as “The Better Mousetrap Fallacy”, and I worry that the climate tech community is at risk of getting caught up in it.

Five years ago, it made perfect sense to seed the market with all manner of new climate tech “mousetraps”, because capital was cheap and we were effectively starting from scratch in many of the most problematic sectors. But, the last five years happened. We’ve reached the end of the beginning. Now capital is scarce, and the market is already brimming with promising mousetraps. Increasingly, the biggest barriers to deployment are not the kinds of problems that better mousetraps have much hope of addressing — e.g. the FFOAK financing bottleneck; regulatory obstacles; infrastructure timelines; and the nearly insurmountable home court advantages of fossil fuel in some sectors.

Plus, if the past twenty years have taught us anything, it’s that the climate tech community tends to overestimate the power of better mousetraps, and underestimate the power of learning curves to make the mousetraps we already have much, much cheaper.

I want to be careful here, because: A) I really, truly don’t want to discourage creative entrepreneurs from trying new things; and B) It is, after all, my job to try to invest in better mousetraps at Energy Impact Partners.

So I want to be clear that the Better Mousetrap Fallacy is not a universal maxim. There are still better mousetraps worth investing in — hopefully, lots of them. However, I believe that the maturation of climate tech — as a market, and as a community — means that we need to be even more discerning about which new mousetraps are worth pursuing, and which are more likely to be distractions.

The question, of course, is how to make that distinction. So, let’s consider some examples, beginning with nuclear power.

Here’s a landscape of nuclear reactor technology companies, courtesy of my EIP colleague Johnny Daugherty:

This is actually just a small subset of companies attempting to bring new fission reactor technology to market. One of our utility partners at EIP has been tracking more than eighty startups in this space.

I believe that this proliferation of nuclear companies has become an impediment to progress in the nuclear industry. This cornucopia of options, however theoretical, is actually making it more difficult for governments to align with industry on a concerted program of deployment. Ultimately, selecting a very small number of reactor designs (perhaps as few as one) and then committing to build at least 5-10 units in fairly rapid succession, is probably the best strategy for reinvigorating the nuclear supply chain, and rebooting the learning curve. Substantial cost savings were realized even amidst the construction of the first two new nuclear units in more than 40 years, at Georgia Power’s Plant Vogtle. According to the Department of Energy, the cost of Vogtle Unit 4 came in about 20% below the cost of Unit 3.

Let’s move on to energy storage, another domain which I view as perenially afflicted by the Better Mousetrap Fallacy.

I’ve been a close observer of the energy storage market for over a decade, first as a market analyst, and now as an investor. Throughout this period, I’ve received dozens of versions of the same basic pitch: “Once we scale up, our technology will be half the cost of lithium-ion”. Yet nearly all of the companies making this pitch have been making the same mistakes: grossly underestimating lithium-ion battery technology; relying on outdated benchmarks of its cost; and assuming that it had to be nearing the bottom of its cost curve. Meanwhile, lithium-ion has kept on beating expectations and crushing pretenders to the energy storage throne in its wake.

I’m proud to say that we’ve been extremely wary of making this mistake at Energy Impact Partners. We’ve deliberately avoided investing in technology that has any chance of being steamrolled by the lithium-ion juggernaut.

However, that doesn’t mean we’ve avoided investing in storage technology altogether. We’ve actually invested in a handful of better mousetraps in the sector, even amidst an ultra-crowded field. In fact, I happen to believe our energy storage portfolio contains an especially representative sample of better mousetrap design. Our three big investments in the sector span the three major archetypes for better mousetraps which, in my view, might actually be worth the effort.

1. 5-10X better fundamentals: In a market like energy storage, with an incumbent technology that’s making rapid progress, it’s just not worth the risk to invest in a novel solution that can theoretically be made even 2X cheaper. In order to compete on cost with a strong incumbent solution, despite being inherently riskier for prospective customers to adopt, you need to demonstrate a fundamental cost entitlement that’s at least 5X better. Of course, 10X is preferable, and that’s exactly what Form Energy has developed for multi-day energy storage. If you want to store several days worth of energy, there is simply no realistic way for lithium-ion to approach Form’s metal-air cost profile.

2. Completely new applications: Another reason to invest in better mousetraps is to pursue entirely new markets which incumbent solutions have no means of entering. In other words: Don’t build mouestraps at all; build squirrel traps. Form has done this by leveraging its ultra low cost entitlement to define an entirely new product category: multi-day storage. Meanwhile, Rondo Energy, another company in our portfolio, has pursued an alternative route to functional differentiation. Rondo’s solution stores energy in the form of ultra-hot bricks, which means that it can dispatch energy as continuous heat rather than electricity. Not only does this storage medium give Rondo an extremely attractive cost entitlement; it enables the product to serve thermal loads directly. This capability has allowed Rondo to enter an entirely new market — industrial heat electrification — which is simply not open to lithium-ion batteries, or any other electrochemical storage approach. Rondo has quickly emerged as the commercial leader in this space; and I expect that the learning curve from their first major deployments will make it difficult for other mousetraps to catch up.

3. Much better integrated solutions: Sometimes the biggest winners from a technology inflection point are not actually the companies advancing the core technology in question. Instead, they’re the first businesses which successfully put that technology to work in new, category-defining products. Oftentimes this requires integrating multiple bits & pieces of emerging technology together into a cohesive whole. Think about Ford, back in the day. Or Apple. Or, for my fellow millenials: Nintendo. Or Tesla, whose founders had the wild idea to stick “laptop batteries” into a car. In fact, lithium-ion batteries are proving to be one of those foundational technologies (like semiconductors) whose steady advancement is a continuous source of inspiration for new product categories. Grid storage was an early example, and our portfolio company Powin was one of the first companies to package up lithium-ion cells into tightly-integrated, built-for-purpose, modular grid storage solutions. Powin is now one of a small handful of globally recognized leaders trusted to build complex mega-projects in this field. (Note: If you want to take this sort of pathway to building a better mousetrap, it really pays to be one of the first to market. It’s especially crucial to begin your journey down the learning curve a few years before anyone else.)

Maybe all that is just a fancy way of saying: Better mousetraps need to be much, much better. Otherwise, they’re probably a waste of time & capital — and perhaps even worse — distractions from getting on with the business of learning by doing.

Stay tuned for the third and final post in this series.

Great job (again!) on this post.

I appreciate the clear way of looking at what would make sense to invest in.

These first two posts were a riveting read -- thank you. As someone who has spent my whole career in Climate software, I'm eagerly awaiting Part III.