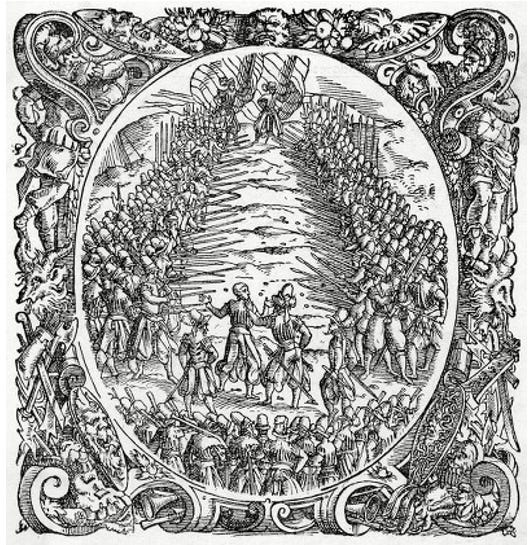

Colloquially, “running the gauntlet” means navigating a narrow passage between two daunting challenges or threats. Apparently, the phrase was derived from a centuries-old swedish military hazing ritual, depicted here:

About a year ago, the concept of a looming gauntlet struck me as an appropriate metaphor for the trajectory of the electric power industry. Admittedly, this was more of a vibe than a rigorous analysis of the facts. In my job at Energy Impact Partners, I have the good fortune of engaging regularly with operators from most corners of the electric power business, and “The Electricity Gauntlet” was basically my read on the zeitgeist.

Then my partner Shayle and I made a podcast about The Gauntlet, and we realized we’d struck a nerve. I’ve spent the past six months or so sharing this vision with a wide range of leaders from utility companies in North America, and it seems to resonate more with each passing month.

I’m now thoroughly convinced that The Gauntlet is going to be one of the most important lenses for making sense of the energy transition for several decades to come. In order to navigate it together, we all need to understand what we’re getting ourselves into.

So, here goes.

What is The Electricity Gauntlet?

It’s a narrow passage for the electric power sector which runs between two generational challenges closing in on either side: the power grid’s version of those Swedish pikemen.

On one side of The Gauntlet, those pikemen represent the sudden, fervent return of electricity demand growth in North America & Europe. This is a marked change from the past twenty years, in which electricity demand was basically flat, in aggregate, across advanced economies.

Before this lull in electricity demand, growth in the last few decades of the 20th century was propelled by the gradual adoption of more & more electric appliances. Not so today. Instead, the first pikemen we face are a set of enormous new electricity consumers: notably, data centers and industrial sites. And just beyond these massive, individual electric loads stands an army of electrification opportunities, stretching as far as the eye can see, and already marching steadily forward.

Consider a few data points…

Data centers & AI

Over the past decade, the impact of tremendous growth in demand for computing was largely concealed from the electricity grid by equally tremendous improvements in the energy efficiency of data centers. Computing workloads were shifted from old, inefficient desktops & corporate server closets to hyper-efficient, hyper-scale data centers operated by some of the most sophisticated computing geniuses in the world.

This shift underpinned one of the most extraordinary, and in my opinion most underappreciated trends in the history of energy: In the past decade, demand for data center computing grew by nearly 10X, while data center energy use grew by about 10%.

That’s friggin’ bonkers! Frankly, I wouldn’t believe it if the International Energy Agency didn’t say it was so.

The thing about this miraculous trend, however, is that it’s effectively over. Nearly all of those old, cord-clogged server closets are empty. We’ve already shifted most of the workloads that we’re going to shift into hyperscale data centers. And within those hyperscale data centers, additional investments in efficiency have begun to encounter wickedly diminishing returns. Google, Microsoft, et al have now plucked all of the low-hanging fruit, and then some.

Plus, now there’s Generative AI.

Here’s a fun fact about large language models: Back in 2011, the New York Times reported that running a single Google query consumed about a third of a watt-hour. (Given the tremendous efficiency gains achieved since 2011, it seems very likely that Google queries now consume much less.) Today, multiple researchers have estimated that running a single ‘query’ with ChatGPT consumes about three watt-hours.

So, given a very similar computing task, the Generative AI approach requires more than ten times as much energy.

Growth in computing demand has led to growth in data center scale. Individual facilities used to be rated in tens of megawatts. Now they’re often rated in hundreds of megawatts, and I’ve heard tales of a number of gigawatt-scale data centers in the works.

There is simply no way to conjure gigawatts of power supply as quickly as data center developers are now requesting them. Consequently, utilities are having a hard time keeping up. Most publicly, the Mid-Atlantic utility Dominion Energy had to tell data center developers that it lacks sufficient transmission capacity to support additional data center demand in Northern Virginia until 2026. Similar stories abound. For example, due to lack of timely power supply in Oregon, Amazon announced plans to power three data centers with Bloom Energy fuel cells, fueled with natural gas, right on site.

America’s industrial renaissance

The first two years of the Biden administration ushered in a new period of US industrial policy aimed at jumpstarting US manufacturing in key sectors. I personally believe this is a very good idea. Frankly, investing in domestic supply chains for critical energy and security related products ought to be a no-brainer. So, I’m glad that batteries and microchips are finally getting some love from a recent spate of bills.1

And what’s more: these bills actually appear to be working! At least, sort of... As Noah Smith has pointed out, they’re probably not working as well as they could be if their architects had been more mindful of all the ‘soft’ hurdles to building new infrastructure in the US today. Unfortunately, they haven’t addressed permitting delays, labor shortages, or the kinds of burdensome requirements which Ezra Klein characterized as “Everything Bagel Liberalism”. (In some ways, recent policies actually seem to be exacerbating these problems.) Yet still, construction investment in US manufacturing has more than doubled since before these bills were passed. (On the other hand, we’ve yet to see real manufacturing output follow suit...)

In any case, assuming that at least some of the factories which the federal government is promoting are actually commissioned, they’ll need to be powered. Hence, America’s manufacturing renaissance is also contributing to The Gauntlet.

Here’s another fun fact: It takes about 50 kWh of electricity to manufacture 1 kWh of battery cells. If you add up all the credible announcements regarding new battery manufacturing in the US, you get about 1 TWh of annual cell production, which suggests up to 50 TWh of additional power demand. That’s over 1% of our total annual electricty supply! (In case that doesn’t impress you, please remember: anything that registers in single digit percentages of US power demand is a massive amount of energy.)

Utilities are already having a tough time keeping up with this industrial load. And it’s a lot tougher to say “seeya later” to a factory than a data center, because the economic benefits of industry are even more politically painful to miss out on. Hence, the electric utility Evergy, whose footprint spans much of the state of Kansas, recently announced that it would need to keep a coal-fired power plant running longer than expected, in part because of a giant new Panasonic battery plant under construction in its service territory.

Electrification (and electrolysis)

For the electric power business, the prospect of “beneficial electrification” has been tantalyzing for at least the past decade.

It’s important to remember that only about 20% of energy is currently delivered to consumers in the form of electricity. The rest is delivered (mostly) in the form of fossil fuel, then converted into useful heat or motion directly in an engine, furnace, or boiler. Hence, electricity has plenty of aggregate energy market share left to win; and the electric power industry has viewed the promise of decarbonization as just the impetus that consumers need to make the switch. Electric utilities in particular have been keen to hasten this transition.

Now, all of a sudden, electrification is finally happening. Grid operators are already beginning to feel the effects, and that’s layered on top of the impact of data centers and manufacturing facilities. I have a sense that many industry leaders are recalling the old adage: “Be careful what you wish for”.

Consider:

Light duty electric vehicle adoption has surpassed 15% of new vehicle sales, globally, and even in the laggard US market EVs are approaching 10% market penetration.

Medium duty vehicles may be following close behind. Major fleet operators view electrification as the best path to decarbonization, and there are studies which suggest EVs are on track to be the right economic choice, period, for a growing share of routes.

Electric heat pumps are also gaining momentum. In the US residential market, they overtook natural gas heating systems for the first time in 2022, and they continued gaining market share in 2023. I’ve written extensively about the very real barriers to electric heat pump adoption. But, I nevertheless believe that they’re on track to become the dominant heating solution for the majority of buildings. Companies like Quilt are developing products with superior efficiency and design which I’m confident will continue to win over more of the market.

Don’t expect electrification to stop with these ‘obvious’ opportunities. In our portfolio at EIP alone, we already have two battery electric replacements for portable electric generators (Moxion and Instagrid); two game-changing electric alternatives for industrial heat (Rondo and AtmosZero); novel processes for electrifying the production of cement (Sublime) and steel (Boston Metal); and even electric autonomous LAWNMOWERS (Scythe Robotics). The list goes on. Yes, the slogan “electrify everything” is kind of silly. But it turns out that there are indeed lots of things that we can, and should, electrify.

And then there’s hydrogen electrolysis, which is effectively a form of indirect electrification. The hydrogen market is admittedly very early, and very difficult to predict. (I’ve written a lot about the challenges in this market, as well.) Regardless, because of the generous subsidies offered by the Inflation Reduction Act2, electricity grid operators have recently encountered a host of hydrogen project developers, knocking on their doors, ostensibly lining up for gigawatts of clean power supply… with varying degrees of credibility.

We’ve already entered The Gauntlet

In the past six months, signs that we’ve entered The Gauntlet have become impossible to ignore. Most importantly, we’re seeing power demand growth surging faster than just about anyone anticipated as recently as a year ago. For example…

In October 2023, Southern Company filed an integrated resource plan projecting 6.6 GW of load growth through 2030, which was 6.2 GW higher than its forecast just a year previously! In testimony to regulators, Southern Company leadership stated: “Nothing in the company’s or state’s history would have predicted load growth of this magnitude or that such growth would occur so rapidly.”3

Another Southeast utility Duke Energy, published a new resource plan this January, noting “We’re already projecting eight times the load growth we anticipated just two years ago… This additional demand for energy is unprecedented – historic in both size and speed.”4

The multi-state utility First Energy simultaneously announced a big increase in its five-year capital plan while publicly shelving its goal of reducing carbon emissions by 30% by 2030.5 The company cited resource adequacy concerns and state energy policy goals in its decision to keep two large coal-fired power plants running longer than previously planned. (First Energy has maintained its commitment to achieving net-zero emissions by 2050.)

This phenomenon is not contained to specific utility service territories. In December, the North American Electric Reliability Corporation released its annual risk assessment, which found that the chance of running short on generation capacity had risen substantially since its last study. More than half the continent is now at elevated or high risk of capacity shortfalls.

In short: The grid has suddenly become starved for firm capacity.

On the other side of The Gauntlet, providing firm capacity is getting harder

Unfortunately, all of this new electricity demand is arriving just as electric utilities have found themselves in a capacity crunch. There are multiple factors, at every level of what we think of as “the grid” which are making it difficult to deliver more clean electrons to consumers. In fact, it has become a lot harder to deliver more electrons, period.

Around 50 GW of coal-fired power plants are scheduled to retire by the end of the decade, which equates to about 5% of peak load across the US. This effectively means grid operators are starting the game from behind. It’s no surprise we’re beginning to see some of these retirement plans significantly delayed, as in the Evergy and First Energy examples I noted above.

Meanwhile, at the other end of the carbon spectrum, we have renewables. Mostly, at this point, we have wind and solar power, which are now widely considered to be the core building blocks of the energy transition. That consideration was well earned over the past decade. But unfortunately, in this decade, renewables have begun to go through a “rocky adolescence”. Just as we find ourselves with an urgent need to accelerate deployment, renewables have become burdened by a slew of growing pains: notably: higher interest rates, profitability concerns, and most importantly transmission congestion & interconnection delays.

On average, new electric transmission lines in the US take about ten years to develop, primarily because of painful, drawn-out permitting processes. Lines over 500 miles long take more than 15 years, and those are the lines which are especially crucial for unlocking the best renewable resources. Hence, transmission has become a critical bottleneck… probably THE critical bottleneck… to the timely deployment of affordable renewables. Whether we’ll be able to clear the path for ‘enough’ transmission is, in my view, the first big Question for the energy transition.

Additionally, while renewables can provide cost-effective, zero-carbon energy, they don’t provide firm capacity. (In wonky grid operator terms, you can think of “energy” as raw joules. Think of “capacity” as joules specifically when you need them, for as long as you need them.) Storage can already help quite a bit on this front, and I’m extremely bullish on the future of multi-day storage technology to complement renewables as a firm capacity resource (ahem, Form Energy). However, I don’t see grid operators becoming sufficiently confident in any form of storage to bet gigawatts on it in the next few years. Plus, storage is purely a capacity resource, not an energy resource. Today, the grid needs both capacity and energy, so storage only gets you so far.

So today, aside from ushering coal plants back from the edge of retirement, the most sure-fire way for grid operators to add gigawatts of firm capacity intended to operate at high capacity factors is to build new natural gas generation. In the words of a utility friend (who shall remain nameless), natural gas is “the closest thing we have to an easy button… in a world without easy buttons”.

But natural gas is complicated, because obviously continuing to burn massive amounts of methane without abating the resulting carbon emissions is incompatible with long-term carbon goals. It’s also incompatible with proposed EPA regulations, which would require gas turbines to either run on a blend of hydrogen, or begin capturing a substantial share of carbon emissions beginning in 2032. Although I have my doubts about the likelihood of this regulation being implemented as proposed, it’s not something that grid planners can simply choose to ignore.

Plus, the spirit of the regulation is based on a legitimate tension. I’ll be blunt: we’re not going to make it through The Gauntlet without adding more gas generation, at least in the next 5-10 years. Hence, as I’ve written in a prior post, we need to stop thinking of natural gas as purely a “bridge fuel” to some entirely renewable future just over the horizon. It’s better to think of gas as a “backstop fuel”: our ultra-reliable friend who we assume will always be there for us. In exchange, we need to do our best to ensure the gas industry remains sustainable, in every sense of the word, which includes the relentless pursuit of lower carbon emissions.

I see three broad strategies for making the most of whatever natural gas assets we need to build in order to traverse the first phase of The Gauntlet.

Two of these strategies are explicitly called out by the EPA in its proposed regulation of power generation emissions: preparing for hydrogen blending, or preparing for CCS.

On the hydrogen front: the big three gas turbine OEMs are already selling hydrogen-retrofit-ready products today, and promising turbines that are prepared for a 100% hydrogen (or ammonia) retrofit by 2030. Hence, “hydrogen readiness”, at least at the turbine level comes at a relatively low cost. However, demonstrating hydrogen readiness also means laying the groundwork to produce zero-carbon hydrogen at scale. I’ll note that our portfolio company at EIP, Electric Hydrogen, is one of the few companies whose products make sense for truly power generation scale hydrogen production.

On the CCS front: CCS may be an option for geographies with the right combination of an amenable regulatory environment and sub-surface geology. However, there are several challenges which have made this approach less common among utilities pursuing new natural gas generation in the next 3-5 years.

Gas turbine OEMs are not yet marketing turbine packages with specific features geared towards CCS retrofit plans (as they are for hydrogen retrofits). Also, high levels of carbon capture have not yet been successfully demonstrated at the scale of a power plant; and the failures of a handful of early projects, like the Petra Nova coal plant, continue to haunt the industry.

Developing ‘class six’ sequestration wells in the US is currently a long and uncertain process. Utilities banking on CCS as a future-proofing strategy for natural gas assets need to begin work on these sites many years in advance of making a decision to invest in carbon capture. For those who are exploring this strategy, I’d recommend a conversation with the team at EIP portfolio company Carbon America, which is at the leading edge of sequestration site development.

The final strategy I want to highlight, which I believe deserves a lot more attention, is building distributed natural gas power generation.

Any planner worth her salt who’s developing new gas generation assets today is surely eyeing future scenarios in which those assets are run much less frequently. In an increasingly carbon-constrained environment,we should expect that most natural gas assets will be consigned to lower & lower utilization duty cycles. They might only be called on during occasional periods of extraodinarily high demand for energy, or especially big lulls in renewable power supply.

In these scenarios, I believe natural gas assets will be able to retain the most value when they’re located at the “grid edge”, where they can contribute value to energy consumers as a source of resilience against outages. Such assets will need to be deployed in a “microgrid” configuration, which means contributing to the grid during normal conditions, but are also maintaining the ability to ‘island’ an individual consumers or group of consumers, when the grid is down. (Check out EIP portfolio company Enchanted Rock, which has, truly, mastered this strategy.)

In fact, I think the concept of microgrids writ large might be one of the biggest winners from the first phase of The Gauntlet we’re entering. Microgrids have been very popular to think about for a long time. (They’ve also been popular to talk about, and to write about...) But today they finally seem like they might be popular to actually build. Just look at Texas, where the grid has been hit especially hard by major weather events in recent years… (Hat tip to my EIP colleague Johnny Daugherty’s work on microgrids for shaping my views on this topic.)

Hence, I’m becoming convinced that microgrids of all kinds - certainy gas, but also local renewables, storage… and perhaps even at some point nuclear micro-reactors (?!?) - will play a role in navigating this challenging phase of the energy transition.

There’s no map

Stepping back… The Electricity Gauntlet is undoubtedly a frightening phenomenon. Many of us thought we had figured out a basic game plan to reach net-zero carbon, which looked something like this:

It’s a simple, three step plan. Those are always foolproof, right?

Yes, yes, in general you should beware of simple, three step plans. I do think this one has held up fairly well. However, the Electricity Gauntlet is seriously complicating Steps 1 & 2. Frankly, this should be a very concerning phenomenon for anyone who cares about the future of energy & climate.

So, I suppose all that’s left to say is “Welcome”. Welcome to the next, much more challenging phase of the energy transition. Welcome to The Gauntlet.

I hope that many of you will join me in raising your shields and sharpening your spears. We’re all going to need to get very creative to make it to the other side.

Notably, the IRA, the IIJA, and the CHIPS Acts.

Despite setbacks for some hydrogen projects owing to the Treasury’s strict proposed interpretation of the 45V tax credits.

Georgia Public testimony to the Public Service Commission, Docket No. 55378, “DIRECT TESTIMONY OF JEFFREY R. GRUBB, FRANCISCO VALLE, LEE EVANS, AND MICHAEL A. BUSH”, Dec 2023

“Duke Energy provides resource plan update to South Carolina regulators that reflects state’s booming population, economy”, Duke Energy, Jan 31, 2024.

“FirstEnergy increases 5-year spending plan 44%, to $26B, drops 2030 carbon goal”, Utility Dive, Feb 12, 2024.