Today’s chart comes from Dunne Insights, an excellent source of intelligence on the global vehicle market. I’d highly recommend Michael Dunne’s coverage of the rapidly evolving geopolitical dynamics of the automotive industry. (For starters, check out: “How China is Assisting a European Suicide” and “China is Done with Global Carmakers”.)

In very short order, China has become the world’s top passenger vehicle exporter.

Notes:

This is partially a story about China’s dominance of the electric vehicle supply chain, as nearly a third of China’s vehicle exports were electric in 2023, and that share is set to increase this year.1 Electric vehicles are clearly the domain in which China has the biggest, most durable advantages over more established global automakers.

China controls between 70-90% of global supply at just about every step in the manufacturing supply chain for lithium-ion batteries. Chinese battery manufacturers are by far the global leaders when it comes to cost, and they also continue to push the boundaries of performance. BYD and CATL in particular have now established a track record of being first to commercialize transformational cell chemistries at scale — first LFP, and more recently sodium-ion.

Meanwhile, Europe’s flagship battery manufacturer, Northvolt, recently filed for bankruptcy. As Intercalation Station puts it: “Battery production is genuinely difficult”.

Chinese EV brands are now well regarded for offering remarkably high quality products at an extraordinarily low cost. On that note, it’s not just EV technology which has made China such a formidable auto exporter — it’s the country’s aggregate commitment to manufacturing excellence, bolstered by consistent government support… and, of course, the massive scale of the domestic market. These advantages have enabled Chinese auto OEMs to offer world-beating prices for both EVs and internal combustion vehicles, with an average export price tag of just $19,000. That’s less than half the average of American & European products. Michael Dunne recounts an anecdote…

A friend – and veteran car dealer based in Bangkok – gets frequent quotes from Chinese automakers these days.

“One guy in China – and he sounded very confident – said he can deliver a Territory replica for just $8,000,” recounted my friend. “Look, I sell the real Ford Territory here starting at $32,000. Can you imagine?”

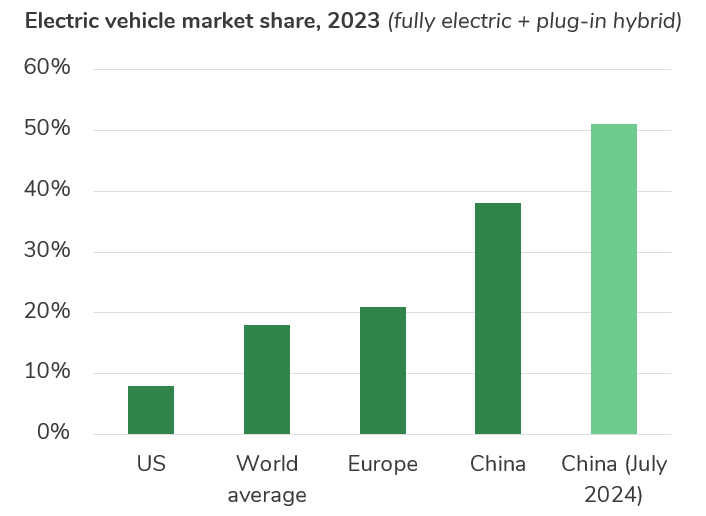

This is part of an even bigger story — perhaps, I’d argue, the biggest story: The interplay of the global energy transition and the geopolitical rivalry between the US and China. As I pointed out recently, the US is a fossil fuel superpower (especially when it comes to natural gas), capable of wielding hydrocarbons as instruments of global influence. China is now even more of an unquestioned superpower when it comes to clean energy manufacturing, and its low-cost EV exports are just the beginning of how it might leverage that position to shape global affairs. China’s rate of EV adoption has pulled away from most other countries, but the rest of the world appears to be following much more closely in China’s footsteps than America’s. How much, I wonder, will the tariffs threatened by the incoming Trump administration turn China’s affordable EV leadership into yet another lever to cleave the US from longstanding allies in Europe and Southeast Asia?

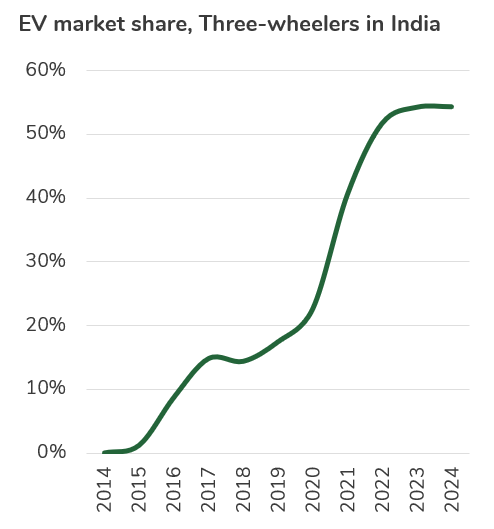

I mean, seriously, check out the market share of electric three-wheel vehicles (e.g. auto rickshaws) in India.

And if you enjoyed this post, I’d also recommend…

“China vehicle exports: electrified”, US International Trade Commission, April 2024.