Finally, the right time for Distributed Energy Resources

"Any utility today can have a VPP program"

“Being right too early is indistinguishable from being wrong.”

- Christopher Ailman, Chief Investment Officer of the California State Teachers’ Retirement Fund

The birth of “DERs”

The term “Distributed Energy Resource” — or “DER”, for those in the know — is not very well defined. It refers to a motley crew of devices which can be deployed out at the “edge” of the power grid, most often sitting on customer premises, with the potential to serve as tools for grid operators.

Here’s a more precise definition (my own) which adds some technical specificity, at the cost of some additional wonkery:

“Any loads, generators, or storage devices interconnected to the electric distribution system or behind customer meters, which can be influenced or managed to help balance supply and demand for electricity on the grid.”

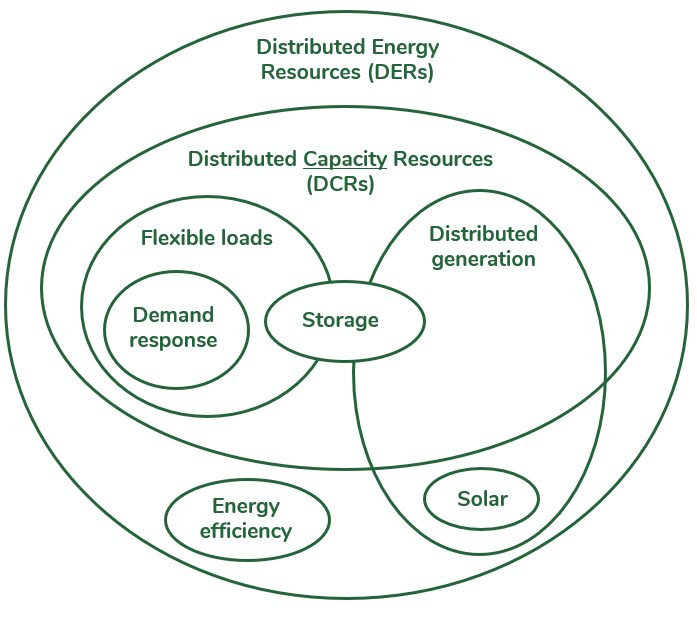

And here’s a diagram which lays out all of the major sub-categories of DER (with some additional definitions in the footnote:1)

“DER” first entered the energy industry lexicon a little over a decade ago. I’m not sure where the term originated, but I recall it began to be promoted in wonky clean tech circles in the early 2010s. The rooftop solar industry was just beginning to pick up steam, as were two other nascent product categories which could theoretically be harnessed for the benefit of the system: 1) “Smart” thermostats — e.g. Nest and Ecobee; and 2) Lithium-ion battery packs — e.g. Tesla and Sonnen.

The industry needed a catch-all term for these new products, and the companies pitching them were eager to be perceived as “resources” for grid operators — in particular distributed solar, which was beginning to be perceived as a nuisance (rightly so, in many cases). Hence, the industry was keen to promote a friendly umbrella term.

And so, a new category of energy assets was born.

It’s important to note that “DER” is intentionally a big tent, but there is a critical distinction to be made among its constituents: only a subset of DERs can be dispatched in real-time, on-demand. Others — notably energy efficiency and rooftop solar — cannot. Grid planners can certainly offer customers incentives to adopt these resources. (For example, your utility might offer you a few dollars per bulb to swap out your old incandescent lights for LEDs.) With the right programs in place, utilities can certainly count on these resources as contributors to their long-term plans.

However, there is a big difference between DERs with long-term planning value, and DERs with an on-off button.

Resources with on-off buttons are especially valuable to grid operators because of the basic physics of the power system: supply and demand for electricity need to be perfectly balanced at all times. Hence, electrical generation resources (supply) must be capable of matching electrical load (demand) in millisecond timescales. This means that grid operators need to make sure they have enough generation capacity at the ready in order to meet the peak moment of demand on the system, and to respond to rapid fluctuations on either side of the ledger.

So, ideally operators want to be able to push a button, and either rapidly ramp up the amount of power being generated, or ramp down electrical load somewhere on the grid. At the bulk power system level, these types of resources are generally referred to as “Capacity Resources”, so it stands to reason that in the distributed world we ought to call them “Distributed Capacity Resources”, or DCRs. (This term is not yet in regular use, but it should be, and one of our portfolio companies at EIP, Sparkfund, has been evangelizing on its behalf.)

There are three big subcategories of DCR:

Distributed generation: Dispatchable generators, like diesel or natural gas engines, small turbines, “linear generators”, or fuel cells.

Distributed storage: Lithium-ion battery packs, like the aforementioned Powerwall.

Load flexibility: Energy consuming devices that are capable of being called on to consume less, such as HVAC equipment and EV chargers. The original version of load flexibility, which originated around the turn of the century, was known as “Demand Response”. In most cases, these arrangements consist of a large commercial or industrial energy consumer being paid to curtail its energy consumption when called upon, for a limited period of time, up to a limited number of times per year. In some cases, the only technology required is a phone call to a facility operator.

Lastly, there’s yet another three-letter acronym which ties all of these DCRs together: VPP, or “Virtual Power Plant”. A VPP consists of an assembly of DCRs, spread across myriad homes and businesses, plus the software to link them together and the virtual ‘button’ which operators want to be able to push.

Being right too early

There was great hope for DERs in the early 2010s.

The industry was beginning to come down from a short-lived spike in venture capital investment, which we now refer to as “Clean Tech 1.0” (approximately circa 2005-2010). In hindsight, this period is mostly remembered for its failures — predominantly solar and battery technology; but it also yielded a handful of successful companies. And four of the biggest winners were marquee pioneers in the land of DERs:

EnerNOC, a pioneer in the demand response market: founded in 2001, IPO in 2007.

SolarCity, a pioneer in the residential solar market: founded in 2006, IPO in 2013.

Sunrun, the other pioneer in residential solar: founded in 2007, IPO in 2017.

Nest, a pioneer in the smart thermostat market: founded in 2010, acquired by Google in 2014.

By 2015, “DER” was no longer just an industry term of art. It was a community. A rallying cry. A philosophy. True believers heralded the “utility death spiral”. (This was never a realistic scenario, but it sure generated catchy headlines.) New York policymakers launched a massive public process to “Reform the Energy Vision” with a big focus on DERs. California policymakers ordered the state’s electric utilities to launch an unprecedented 1.3 GW procurement for energy storage, of which nearly half was intended to be distributed. Advocates touted the value of deploying DERs as “non-wires alternatives” — meaning alternatives to investments in grid infrastructure — which set utilities and public utility regulators scrambling to study the value of these theoretical “NWAs” and identify where they might make sense. (Yes, our industry really adores a three-letter acronym.)

Entrepreneurs began building companies to help grid operators manage an incoming flood of DERs, such as software to enable VPPs. I’m particularly familiar with this space because my own firm, Energy Impact Partners, invested in a number of the leading companies — including Autogrid (acq. by Schneider Electric); Opus One Solutions (acq. by GE); Tendril (now Uplight, acq. by Schneider Electric); and AMS (acq. by Fluence).

But then, the much prophesied DER revolution failed to materialize.

Instead, DERs entered the doldrums.

Residential solar installations lost their exponential growth trajectory; and the standard bearer, SolarCity, ran into financial trouble (and had to be rescued by a Tesla acquisition).

Smart thermostat sales never really took off exponentially in the first place.

EnerNOC stumbled, and tried to pivot to energy management software. The company was acquired by Enel in 2017 for a fraction of its prior public market value.

Residential batteries were still a popular conference topic, but the only meaningful VPP program was initiated by a small Vermont utility, Green Mountain Power, and limited to just a few thousand customers. (Personally, I thought this program was very clever, and I was surprised that it took years for other utilities to follow suit.)

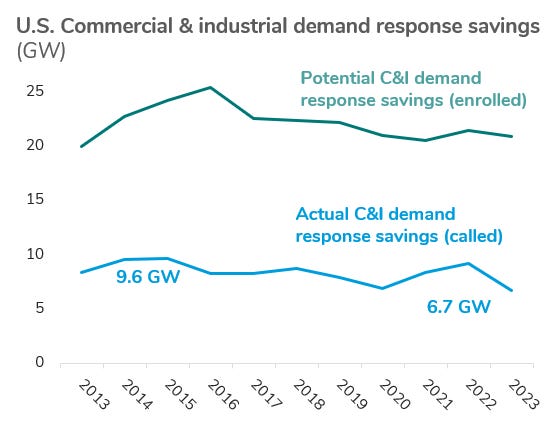

Even that old stalwart of the DER ecosystem, commercial & industrial demand response, lost its groove.

In retrospect, there were two reasons for this disappointing showing by DERs for most of the past ten years.

1. The power grid simply didn’t need DERs very much. One of my first experiences as an employee at Energy Impact Partners involved gathering together a group of utility engineers to discuss distributed energy storage. As a card-carrying member of the DER party, I naively asked the group how many opportunities they had found for batteries to serve as cost-effective “non-wires alternatives” on their systems.

The answer I received was “practically zero”, and not for lack of trying.

It took a while, but I became convinced that these engineers were operating in perfectly good faith — earnestly searching for hot spots on their network where deploying DERs could reduce their overall T&D budgets. They simply didn’t exist.

In large part, that’s because there were so few places where power demand was growing fast enough to necessitate big, costly upgrades to the grid. In addition, markets for power generation capacity across North America were mostly satisfied with existing large-scale resources.

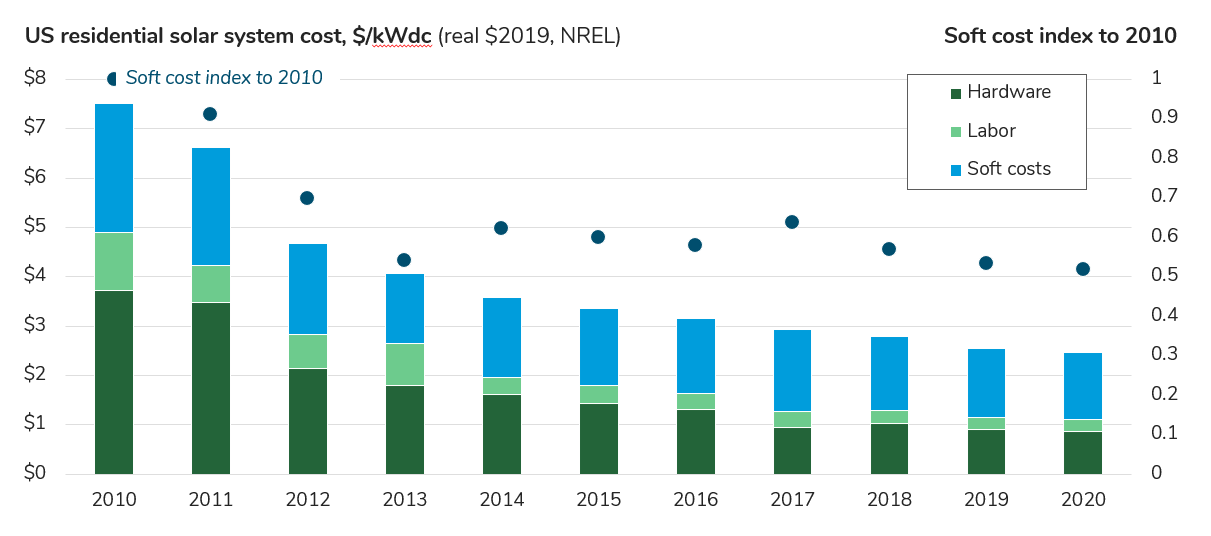

2. DERs cost too much. This may sound surprising, because the cost of all the core hardware in the DER ecosystem has fallen precipitously, and conspicuously. The cost of solar panels, lithium-ion batteries, and all manner of connected devices declined pretty steadily from 2010 onward. (Remember the “internet of things” and the “smart home”?) But what surprised many DER optimists was that the “soft costs” of DER deployment & integration did not follow suit.

In particular, the cost of customer acquisition for just about every category of DER remained stubbornly high through the end of the last decade. In retrospect, the industry probably should not have been so surprised that it was difficult to sell unfamiliar, expensive products which customers didn’t really need. Asking customers to opt in to an unfamiliar utility program, which could potentially disrupt their life or business, probably didn’t help. Hence, DER vendors began to experience upward pressure on sales & marketing costs as they expanded beyond the small pool of early adopters in each segment. You can see the trend playing out very clearly in data from the residential solar sector.

Beyond the cost of deploying individual DERs on customer sites, there was also the cost of setting up the right systems to dispatch them collectively. Utilities quickly learned that these systems would end up costing a lot more, and taking a lot longer to mobilize, than DER proponents were anticipating.

Some of this was a software problem, as each individual DER vendor had its own set of APIs and its own internal grid service initiatives; and each individual utility had its own existing patchwork of grid management systems, which were often highly customized and stitched together over decades. In my experience with many of the leading software startups in this space, these technical issues did become significant speedbumps, but they could certainly be overcome. Much more intractable roadblocks were all related to commercial, regulatory, and organizational friction — which varied across states, utilities, and even departments within an individual utility. For example: Where did DER management sit among utility planning & operating functions? Should VPP operators bid into wholesale (generation) markets, or operate entirely as demand-side resources? How can grid operators avoid double-counting DERs bidding into wholesale markets, which also reduce retail load? How should utilities account for T&D value, and at what level of resolution on the grid? What on earth did FERC Order 2222 actually require, and when will we know for sure???

And so, with no pressing need for DERs, high customer acquisition costs, and hundreds of questions about the right way to handle DERs at scale… The industry spun its wheels into the early 2020s.

And then, over the past two years, everything changed.

Finally, the right time for DERs

Let’s reexamine those two big reasons why DERs failed to take off in the latter half of the 2010s.

1. The power grid simply didn’t need DERs very much. But now it does, desperately.

One of the biggest themes of Steel For Fuel over the past two years has been “The Electricity Gauntlet” — a term I’ve been using for the increasingly precarious path that the electric power sector needs to navigate amidst surging demand for energy, and critical bottlenecks in nearly every step in the supply chain.

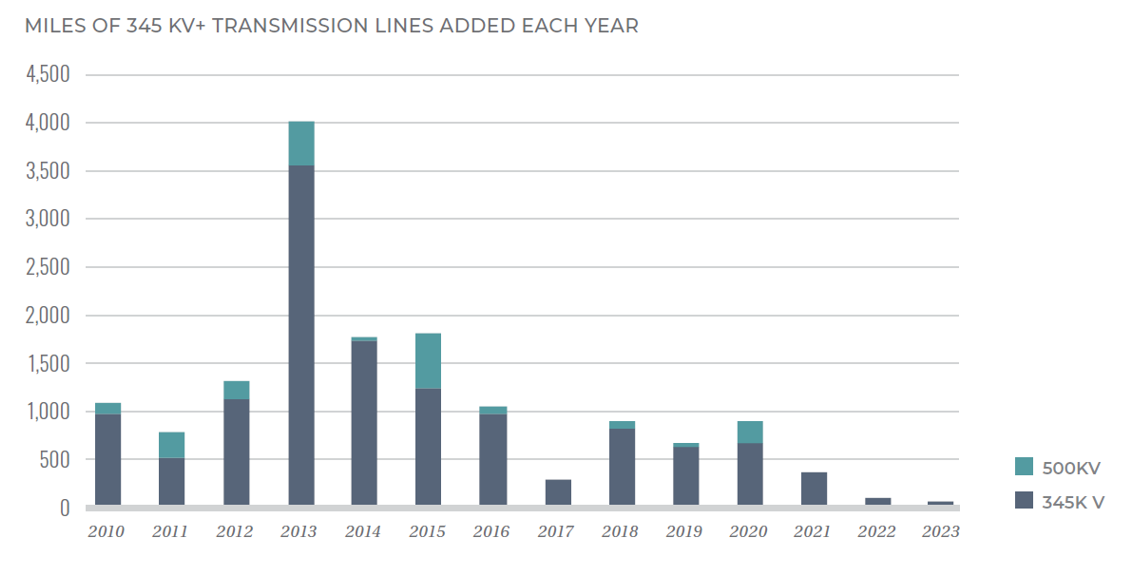

In “Where Have All the Transmission Lines Gone?” I chronicled the slowdown in electric transmission construction over the past decade, which is now beginning to stymie large power generation deployment.

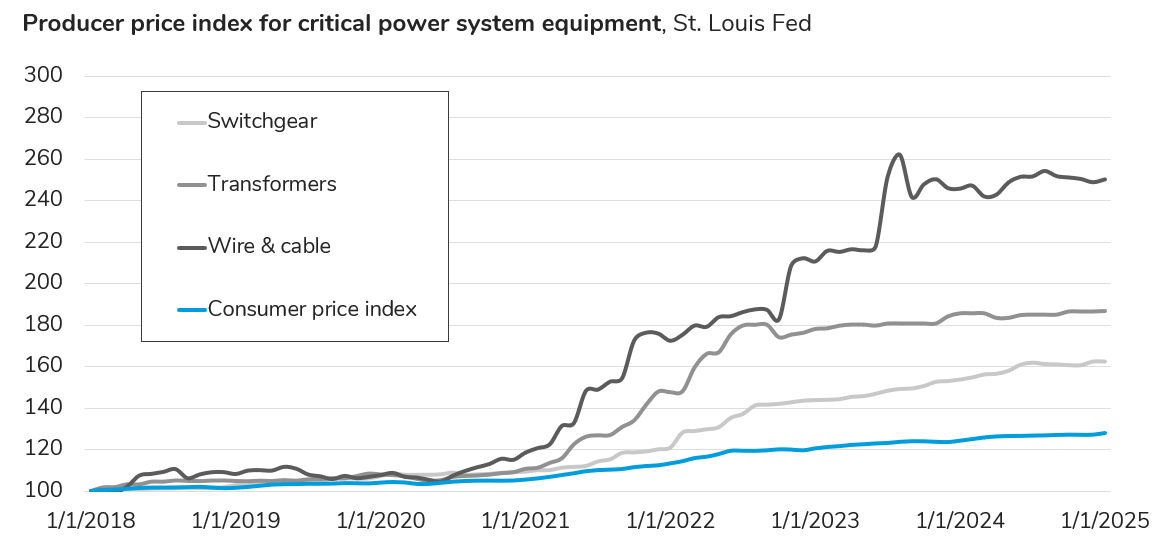

In “The Price of Power Grids” I charted the rising cost of critical power delivery equipment, including transformers, switchgear, and powerlines.

(I also wrote about how steel tariffs are exacerbating supply chain bottlenecks.)

In “Locals Against Renewables”, I highlighted the frustrating rise in state and local ordinances against wind & solar power deployment. Unfortunately the federal government is now piling on with additional burdensome regulation, particularly for wind power, and even stopping multi-billion dollar projects in their tracks with completely arbitrary executive actions.2

Perhaps most importantly, I tried to answer the question “Why Does Nobody Know How Much Energy AI Will Consume” , which is making life extremely difficult for utility planners.

To sum up: We’ve fully entered The Electricity Gauntlet, and there’s no turning back.

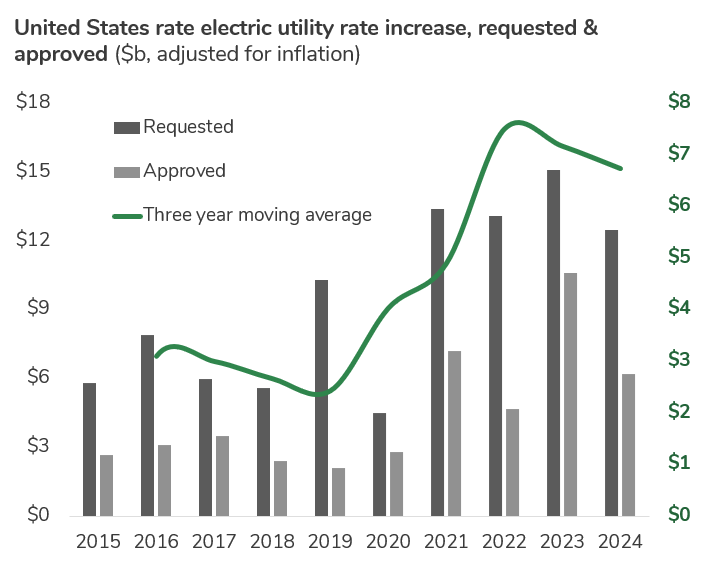

The unsurprising result is that electricity prices are beginning to rise precipitously. Five years ago, DERs couldn’t save the power system very much money.

Now they can.

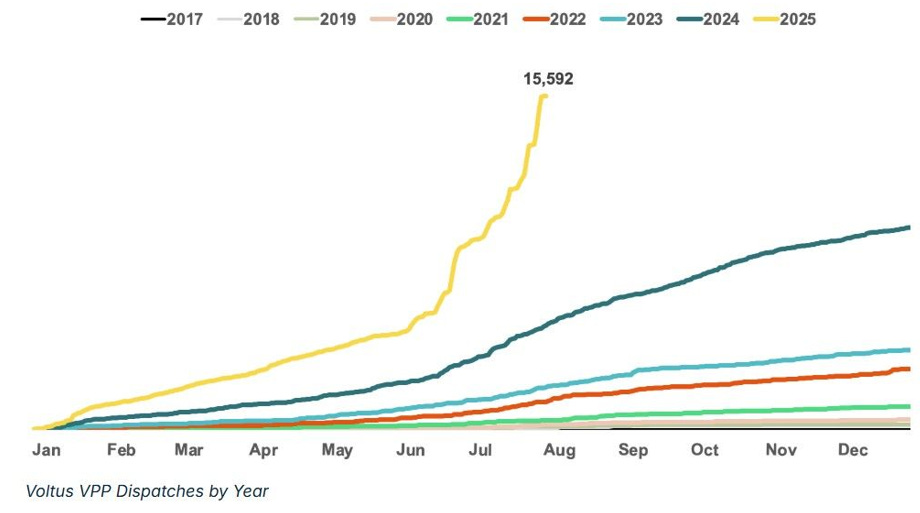

We’re beginning to see real signals in the market that demand for DERs — especially for DCRs — is surging. Perhaps the most telling data points are on the actual utilization of these resources. Just last month, Dana Guernsey — the CEO of the leading demand response aggregator Voltus — posted a chart on Linkedin which immediately caught my attention. This chart shows the number of times per year that the company’s resources have actually been called on by grid operators.

As you can see, dispatches began to pick up in 2024, but are already climbing off the chart in 2025. While the company’s capacity under management has roughly doubled since the summer of 2023, annual dispatches are up by more than six times, and appear to be on an exponential trajectory.

Historically, DERs were often considered “nice to have”, with demand driven as much by regulatory fiat as by real system value. This is the best signal I’ve encountered yet that times have changed.

2. DERs previously cost too much. But they’re becoming cheaper.

While the demand side of the equation for DERs has become more favorable in nearly every respect, the supply side is more of a mixed bag. For example, residential solar costs — including soft costs — have actually trended upward a bit in recent years. But there are promising signs that several other categories of DER are beginning to make progress down the cost curve.

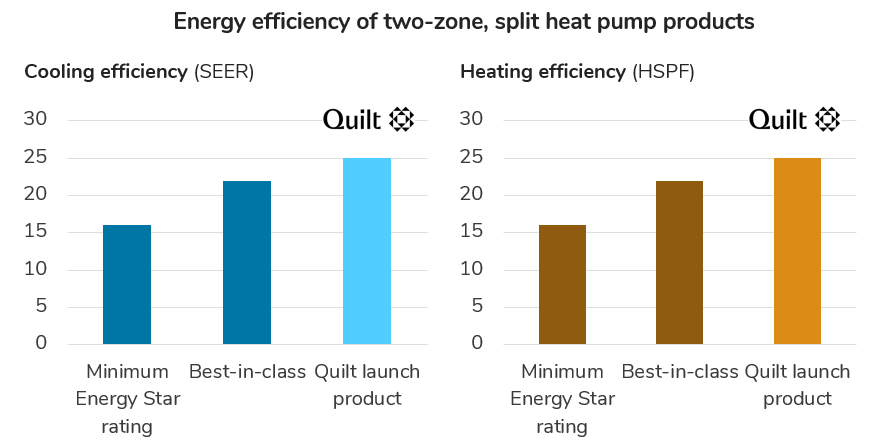

For example, I believe we are on the cusp of a leap forward in energy efficient HVAC technology. I wrote about this previously in “HVAC: The Next Frontier”. Even in mature product categories like household heat pumps, innovators are making progress — see Quilt, one of our portfolio companies at EIP, which recently released the most efficient two-zone “mini split” on the market.3 Quilt’s products are also fully connected, which could enable utilities to yoke them into a VPP. This capability elevates a hyper-efficient heat pump from a DER into a DCR.

But when it comes to DCRs, the crucial category to watch is batteries. Batteries are inherently an attractive class of DCR because they can provide such a high level of flexibility. They can be dispatched instantaneously. They can soak up energy from the grid whenever it’s cheap, then return that energy when it’s dear. And they can perform these feats on a daily basis without their “site host” caring, or even knowing.

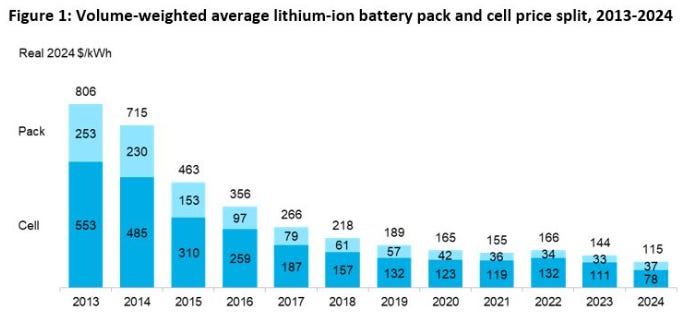

And as everyone knows, lithium-ion batteries became a lot cheaper in the past decade, thanks to the electric vehicle industry. (And China.)

The problem is that this decline in EV battery pack prices has taken a while to translate to the price of stationary batteries for homes and businesses. By 2020, the cost of a fully installed household battery system was still about seven times higher than a similarly sized vehicle battery pack. Installers quickly learned that residential storage faces many of the same customer acquisition hurdles as solar. Plus, the bidirectional nature of storage comes with additional interconnection requirements.

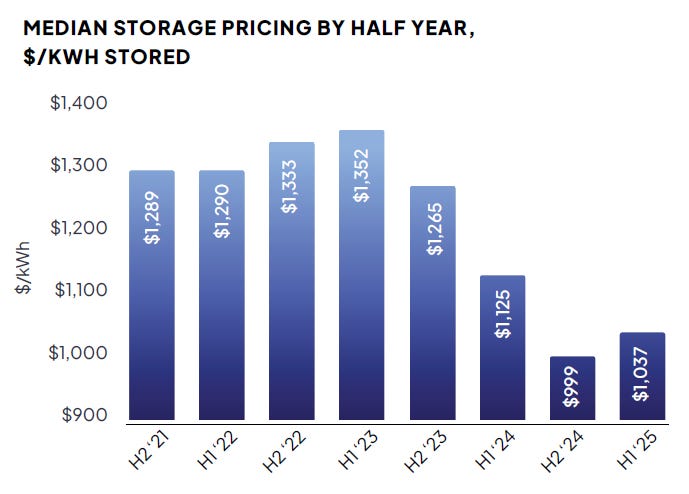

But just recently, we’ve finally begun to see some progress on this front. Data from EnergySage, a perennially fantastic resource on DER pricing trends, shows that household storage system pricing has come down by about 25% in just the past eighteen months.

One of the reasons for this trend is that customer acquisition costs and prices are by no means independent variables: they move together and reinforce each other. As consumer interest in storage has grown, vendors have been able to deploy products more efficiently and unlock greater economies of scale, which has enabled them to lower prices, which has begun to entice more customers… Etc, etc.

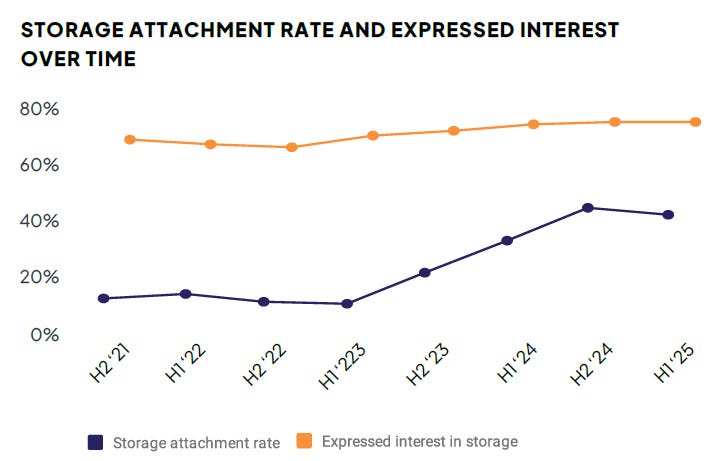

This appears to be what’s happening today. Here’s more data from EnergySage, which shows the share of solar customers who express interest in storage gradually climbing, and more importantly, the share who are actually acting on that interest beginning to take off around the beginning of 2023. (“Attachment rate” has become industry shorthand for the share of solar customers who also opt to add a battery.)

This trend is creating even more positive feedback loops. Once distributed storage reaches enough critical mass to be aggregated into a VPP, storage vendors can begin to give customers a share of the revenue they expect to earn from grid services — ideally in the form of a discount on the purchase price of the battery. This is leading to more batteries deployed… Etc, Etc.

Lo and behold, residential battery VPPs are finally reaching this kind of scale.

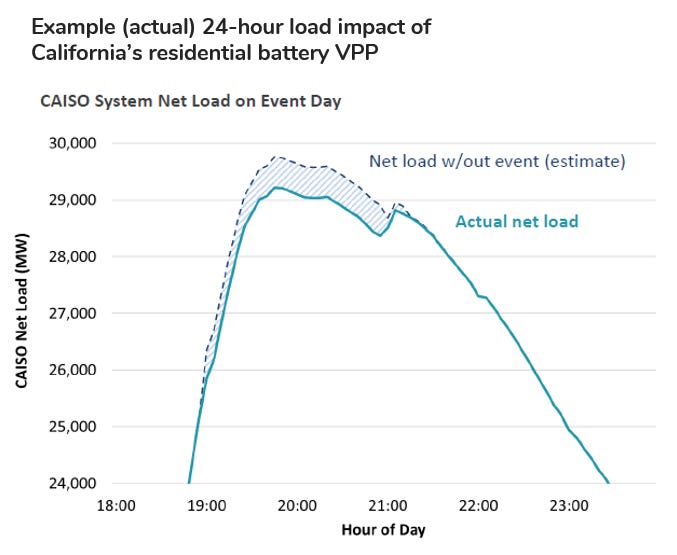

Sunrun, the leading US player in both residential solar and storage, has now aggregated over 75,000 batteries in California alone. The company recently dispatched this VPP in concert with several other aggregators to supply a total of 535 MW to the California grid when the system operator needed it most, on a hot summer evening. At last, we have a VPP which merits the title: this thing has reached the scale of an actual power plant. You can watch it working in real load data from the California Indepdent System Operator.

Over at the Brattle Group, a top industry consulting shop, my friend Ryan Hledik found that the benefits of this VPP to the California grid substantially outweigh the cost.

Is this just a California phenomenon? Not at all. Residential battery demand is definitely not evenly distributed; but we’re beginning to see hot spots pop up across the country. There are a variety of drivers. In New England, building conventional, natural gas fired power plants has become increasingly difficult, so utilities have amassed a combination of batteries, smart thermostats, and other DERs capable of providing 650 MW of peak load management (all wrangled by the leading VPP software company, EnergyHub). In places where consumers are concerned about the reliability of their power supply — e.g. Puerto Rico and Texas — the idea of a backup battery is a big demand driver. One company, Base Power, just raised $200 million to scale a nascent business offering customers an electricity supply agreement which includes installing a practically “free” household battery system. The company can then tap into these batteries as a VPP, in order to mitigate its own peak price exposure in the state’s competitive energy market.

[An aside: One interesting element of Base Power’s strategy is to deploy extra-large residential batteries, with 2-4 times as much energy storage capacity per unit as competing hardware like the Tesla Powerwall. I think the idea is to maximize the degree of freedom that the company can wring from each system as an energy market asset, while also reserving enough juice in order to guarantee each customer a generous supply of backup power. Given that customer acquisition and installation costs are largely independent of battery size, this strategy makes great intuitive sense as a way to reduce the effective cost per kilowatt-hour of storage deployed.]

To top off all of this momentum: batteries are also beginning to be deployed in new form factors which may be able to reduce the cost of customer acquisition, and can certainly reduce the cost of installation. Specifically, clever product designers are integrating batteries directly into energy-intensive devices. For example, a startup company called Copper is now selling gorgeous battery-integrated induction stoves; and the global HVAC powerhouse, Carrier, has launched a field trial for its new battery-backed heat pumps.

Of course, there are still plenty of questions about the direction of distributed battery costs, and all the rest of the DER ecosystem. For example:

Will residential battery costs continue to fall? (I bet they will.)

What about commercial & industrial battery costs? (There’s plenty of room for improvement, although we’ve seen solar developers struggling for years with similar challenges.)

Will there be upward pressure on demand response prices, now that grid operators are actually starting to call on these resources much more often? (I worry that there will be, but I also see providers unlocking more flexibility as they develop more sophisticated approaches — i.e. our portfolio company GridBeyond.)

How will this all play out in utility rate-making, and what will that mean for organic customer demand? (Rates are undoubtedly going up. My bet is that we’ll see especially big increases in the peak-demand-driven portion of electricity rates — e.g. monthly demand charges — and potentially higher fixed charges to boot.)

But stepping back from the particulars: In my experience, economies of scale and learning curves are the two most reliable forces in a modern economy. What makes this moment so encouraging is that VPPs are finally tapping into both of these forces.

“Any utility today can have a VPP program”

Chris Rauscher, who built Sunrun’s VPP program from the ground up, is another friend and fellow Mainer. (Maine!) Last summer, he shared this optimistic quote with Utility Dive: “Any utility today can have a VPP program”

One year later, I’m not only convinced that Chris was right — any utility can have a VPP program — I’m cautiously optimistic that nearly every utility will have one, at real power plant scale, by the end of this decade.

Finally, the time is really, truly right for DERs.

(If you think so too, and have a great idea or a company trying to capitalize on DER momentum, please get in touch: lubershane@energyimpactpartners.com. Also, you should consider attending DERVOS.)

You might also like:

The EV revolution will NOT be subsidized

The US government is pumping the brakes on electric vehicle policy. (Get it?)

Distributed capacity resources (DCRs): A subset of DERs whose dispatch can be influenced or managed to provide reliable capacity to the grid.

Flexible loads: Power-consuming equipment with some flexibility to be turned up or down for varying periods of time.

Demand response: Flexible loads which are committed to reducing consumption for a number of specified periods (typically very few periods, lasting less than 24 hours) throughout the year, in response to a signal from a grid operator.

In case it’s not clear, I belive the Trump administration’s orders to stop all construction activity on the Revolution Wind farm are both illegal and terrible for the United States economy. If the government can arbitrarily shut down multi-billion dollar projects which have been planned & permitted for years, and already under construction, how will anyone be able to make big, long-term investments in this country? This is basic “Rule of Law = Economic Confidence” material.

Nice writeup!

Until we stop calling them an energy resource (DER) they will never achieve mass market (at least at residential scale). They’re customer devices with the primary purpose of benefiting the customer with transport, heat and other things. Until the energy system acknowledges they’re not their assets and must find a way to encourage “good behaviour”. That means dynamic tariffs with short metering periods (where most of Europe is heading).